Local stocks slump on peso weakness

The peso’s depreciation to a 12-year-low against the US dollar ahead of a closely watched US Federal Reserve’s monetary policy-setting dragged the local stock barometer down to the 7,600 level yesterday.

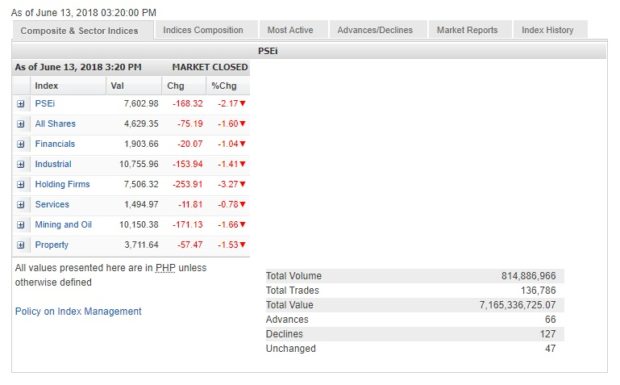

The main-share Philippine Stock Exchange index (PSEi) fell by 168.32 points or 2.17 percent to close at 7,602.98 while foreign selling escalated as the peso crossed the 53:$1 mark.

There was heavy net foreign selling amounting to P1.51 billion for the day.

“The peso depreciation will have a large negative impact on corporations with huge foreign currency debt exposure and primarily earn revenues in Philippine peso,” Papa Securities said in a research note.

On the other hand, the US dollar is gaining ground ahead of the Fed’s decision on a prospective interest rate increase.

All counters ended in the red but the most battered was the holding firm counter, which lost 3.27 percent.

The financial, industrial, mining/oil and property counters all slid by more than 1 percent.

Value turnover for the day amounted to P7.16 billion.

There were 127 decliners that overwhelmed 66 advancers while 47 stocks were unchanged.

Conglomerates Ayala Corp. and DMCI were among the biggest PSEi losers, both dropping by more than 4 percent.

SM Investments, the day’s most actively traded company, slipped by 3.02 percent while Metrobank, Jollibee, GT Capital, ICTSI and URC all declined by over 2 percent.

Ayala Land, BDO, SM Prime, Meralco, Megaworld and Metro Pacific all declined by more than 1 percent. Security Bank and BPI also slipped.

Notable gainers for the day were companies outside the PSEi.

Third telco aspirant Now Corp. gained 8.24 percent. It obtained approval from the Securities and Exchange Commission to raise as much as P1 billion from an offering of preferred shares.

Chelsea, also deemed as a third telco aspirant, likewise gained 4.71 percent.

Integrated gaming operator Bloomberry added 2.61 percent.