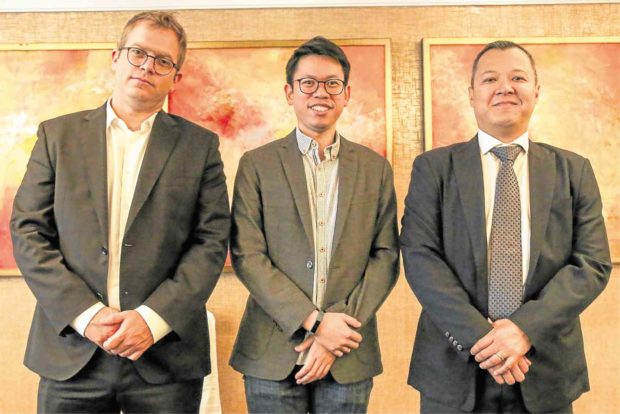

PARTNERS FOR OFWS. (From left) Madanes Group CEO Ohad Madanes, PhilCare CEO Jaeger Tanco, and Jardine Lloyd Thompson Insurance and Reinsurance Brokers CEO Raul Tan

A new medical insurance product designed specifically to help the Philippines’ bagong bayani (new heroes) cover the cost of emergencies and other medical issues in their families back home is now available.

Bayani Family Care, as the name suggests, was developed to address the need of overseas Filipino workers (OFWs) to care for their loved ones in sickness and in health, especially as they could not be physically present to help in their family’s hour of need.

Starting at a minimum rate of P4,350 (around $80) a year per person, the medical insurance product is the result of a collaboration among the Israel-based Madanes Group, Jardine Lloyd Thompson (JLT) and PhilCare.

The health insurance package, renewable every year, covers emergency care and confinement. It offers, among other things, three ward plans with different annual benefit limits: Pearl, P60,000; Emerald, P80,000; and Diamond, P100,000.

In a press conference to launch the medical insurance product in Manila, Ohad Madanes, chief executive officer (CEO) and president of the Madanes Group, which develops medical insurance programs for insurers around the world, said they learned from Filipinos in Israel, which hosts some 30,000 OFWs, the financial strain that a medical problem in their families could cause.

Money earmarked for basic necessities had to be spent on medical care, leaving the OFWs’ families with very little to live on, Madanes heard from OFWs. He learned that some families had to borrow money at usurious rates to deal with emergencies.

“We wanted to give them (OFWs) a product that would respond to their health needs,” Madanes said.

Shai Levy, executive director of the Madanes Group, said they wanted to help the hardworking Filipinos in Israel and empower them.

“We wanted a way for OFWs to manage their cash remittances and ensure they are used for the right purposes,” he said.

JLT president and CEO Raul Tan indicated that while the new medical insurance program would initially target OFWs in Israel, it could be made available to other overseas Filipinos. “Many Filipinos work outside the country to support their families but medical emergencies often wipe out their savings,” Tan said.

They developed the innovative Bayani Family Care package, he said, to respond to the specific need for health care of families of OFWs.

The product would not cost a lot but would give overseas Filipinos peace of mind.

“OFWs are Filipino heroes,” said Philip Samson, JLT deputy CEO and head of benefits solutions. Calling the new insurance product a “noble product with a noble purpose,” he said they hoped to bring it to the rest of the country and let families of OFWs have access to quality health care.

Jaeger Tanco, CEO and president of PhilhealthCare Inc. (PhilCare), a multiservice health maintenance organization (HMO), said only about 4 percent of Filipinos were enrolled in HMOs. When medical problems occurred, they would seek the help of relatives working abroad. Tanco added that more than half of the money sent by overseas Filipinos went to medical expenses.

Raymond B. Tiangco, PhilCare senior assistant vice president and business development head for sales, said the Bayani package was designed specifically for when health insurance was most needed—emergencies and hospital confinement.

Available to Bayani Family Care clients is the PhilCare network of expert services from more than 500 accredited hospitals and clinics across the Philippines and about 30,000 accredited physicians.

Other benefits include basic life coverage and optional cover for unlimited outpatient consultations.

Samson said clients did not have to deal with paperwork to sign up for the Bayani Family Care. Enrolment could be done online, even with a smartphone. No medical examination would be required for enrolment.

Levy said there was no limit to the number of people who could be covered by the medical insurance package.

The annual premium has to be paid in full through the client’s credit card or payment centers OFWs use. Samson said BDO would allow its clients to make staggered payments within six months.

Levy said they were working with other financial institutions for a similar accommodation. —CONTRIBUTED