Philippine stocks fell sharply on Wednesday, tracking negative sentiments across the region as investors took money off the table on the political turmoil in Italy.

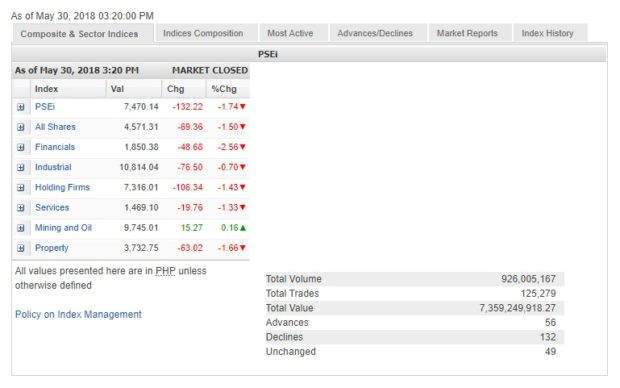

The benchmark Philippine Stock Exchange index (PSEi) fell below the key 7,500 support level, shedding 1.74 percent or 132.2 points to 7,470.14 by the closing bell.

“The crisis in Italy has just started and another one could be triggered in Spain if the populist factions win,” Papa Securities said in a research note, referring to elections in those countries.

“The July 29 elections in Italy and upcoming elections in Spain will put a measure of uncertainty in the world markets,” it added.

Papa Securities said the PSEi could seek a “new low” around 7,100 to 7,200. On Wednesday, only mining and oil managed to close in the green with a gain of 0.16 percent.

The biggest losers among subindices were financials, down 2.56 percent, and property, down 1.66 percent.

Data from the PSE showed that a total of 926 million shares valued at P7.36 billion changed hands. There were 132 decliners while 56 companies gained and another 49 closed unchanged.

SM Prime Holdings Inc. was the most actively traded as it sank 1.33 percent to P37 a share. This was followed by BDO Unibank Inc., down 1.46 percent to P128; Ayala Land Inc., down 1.95 percent to P40.20; Ayala Corp., down 1.01 percent to P930.5, and SM Investments Corp., up 0.06 percent to P860 a share.