The local stock barometer tumbled to the 7,500 level on Wednesday as jitters over a historic US-North Korean summit and the freefall of the Turkish currency spooked regional markets.

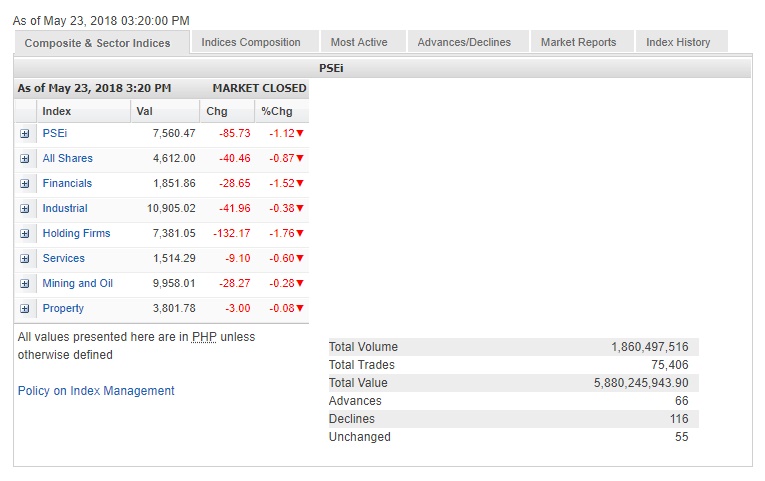

The Philippine Stock Exchange index (PSEi) fell by 85.73 points or 1.12 percent to close at 7,560.47, tracking the downturn across most equity markets in the region.

The doubts cast by US President Donald Trump on a historic summit with North Korea and the sharp depreciation of the Turkish Lira kept regional investors at bay.

Joseph Roxas, president of Eagle Equities Inc., said the index remained locked within a trading range of 7,500 to 7,800.

Papa Securities said the story remained the same for the index, with the PSEi “being driven by foreign flows and investors staying on the sidelines for any signal of a strong catalyst.”

The market was weighed down by P649.85 million in net foreign outflow for the day.

All counters ended in the red but the biggest decliners were the financial and holding firm counters.

There were nearly twice as many decliners (116) as advancers (66) while 55 stocks were unchanged. About P5.88 billion worth of stocks changed hands at the local bourse for the day.

Globe Telecom fell by 5.46 percent while SM Investments—the day’s most actively traded company—declined by 3.52 percent. BPI lost 3.39 percent while JG Summit and GT Capital all declined by more than 2 percent.

Ayala Land, URC, BDO and ICTSI all slipped by more than 1 percent while Ayala Corp., Meralco and Metrobank also slipped.