The local stock barometer is seen striving to stay afloat the 7,500 mark this week as recent rallies have been capped by foreign outflows and renewed concern on the upswing in oil prices.

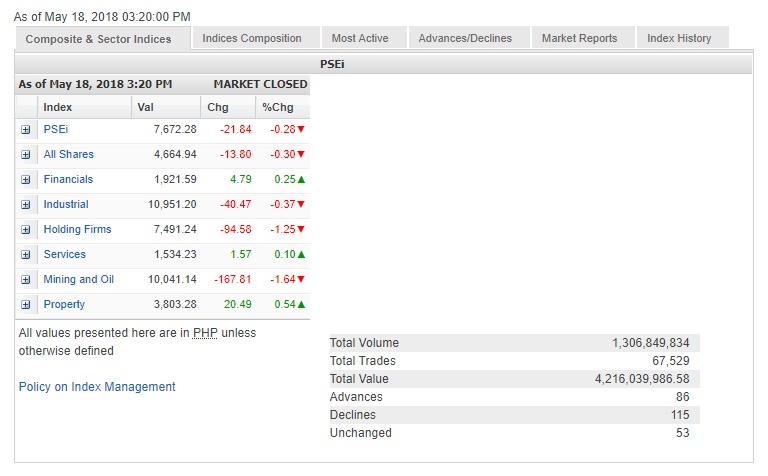

Last week, the main-share Philippine Stock Exchange index (PSEi) fell by 1.03 percent to end at 7,672.28 on Friday.

“It’s just unfortunate that we are seeing an emerging investment-led growth in the economy this year (as opposed to a consumption-led one) being curtailed by higher oil prices in the world economy,” Papa Securities said.

“The PSEi seems poised to retest the 7,500 support for the fourth time. It seems likely that it will break 7,500 this time if it is retested,” it said.

The brokerage said a lot would demand on cost-push factors, particularly oil prices, which are, in turn, determined by geopolitical dynamics and beyond local control, the brokerage added.

A break below 7,500 will trigger programmed selling, which could abate only around the 7,100 area, Papa Securities said, thereby recommending a sell on any rally.

Rising oil prices have put inflation concerns on center stage again, boosting prospects of another round of interest rate increase, said BDO Unibank chief strategist Jonathan Ravelas. He added that higher commodity prices and a weaker peso have also put consumers into a “worried state. “

“Chartwise, the week’s close at 7,672.28 highlights the market’s inability to sustain the rally above the 7,800 levels. The market was short of our 8,000 levels bounce. It only managed to top at 7,906.45 (last) week. Expect a retest of the 7,500 levels,” Ravelas said.

Any rebound is seen to be limited to the 7,900 to 8,000 levels, Ravelas said.

Last week, only the property sector ended in the green as several companies reported tremendous growth in the first quarter, said Christoper Mangun, head of research at Eagle Equities Inc.