The local stock barometer firmed up slightly on Thursday as the first quarter Philippine growth rate of 6.8 percent came in line with market expectations.

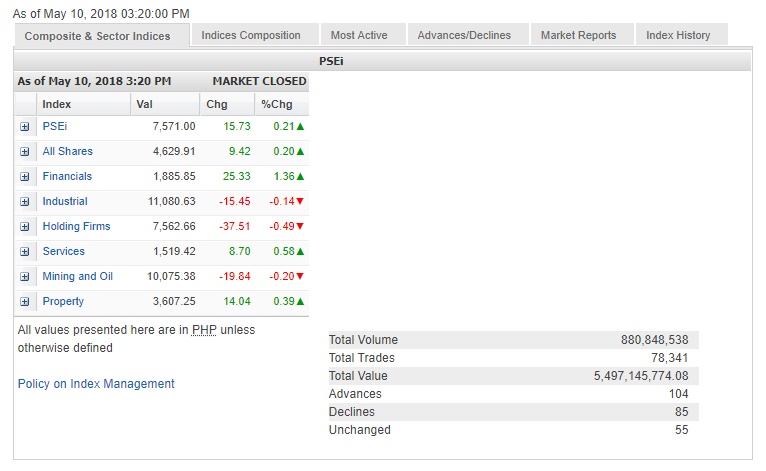

Ahead of the Bangko Sentral ng Pilipinas’ (BSP) monetary policy announcement, the Philippine Stock Exchange index (PSEi) gained 15.73 points or 0.21 percent to close at 7,571.

Likewise in line with expectations, the BSP raised its key interest rates by 25 basis points to 3.25 percent, the first hawkish move taken since 2014.

This was welcomed by the market as the token rate hike could help curb rising inflation pressure and stabilize the weakening peso.

The market was supported mostly by domestic investors while foreigners continued to unload their shares.

There was P1.11 billion in net foreign selling for the day.

The PSEi was led higher by the financial counter, which rose by 1.36 percent.

Higher interest rates tend to benefit banks in the form of improving loan margins.

The services and property counters also gained slightly on Thursday, while the industrial, holding firms and mining/oil counters dipped.

Value turnover for the day was thin at P5.5 billion.

There were 104 advancers that edged out 85 decliners while 55 stocks were unchanged.

The PSEi was led higher by banking stocks Metrobank, BDO and Security Bank, which all gained over 2 percent. PLDT also added 2.53 percent.

SM Prime and GT Capital both advanced by 1 percent, while ICTSI and Aboitiz Power contributed gains.

Outside of the PSEi, notable gainers included Vitarich and MacroAsia, which both surged by over 6 percent.

The day’s most actively traded company was Century Peak Metals, which rose by 1.21 percent.

On the other hand, Jollibee and SM Investments fell by over 1 percent while BPI, Metro Pacific, AEV and Ayala Corp. also slipped.