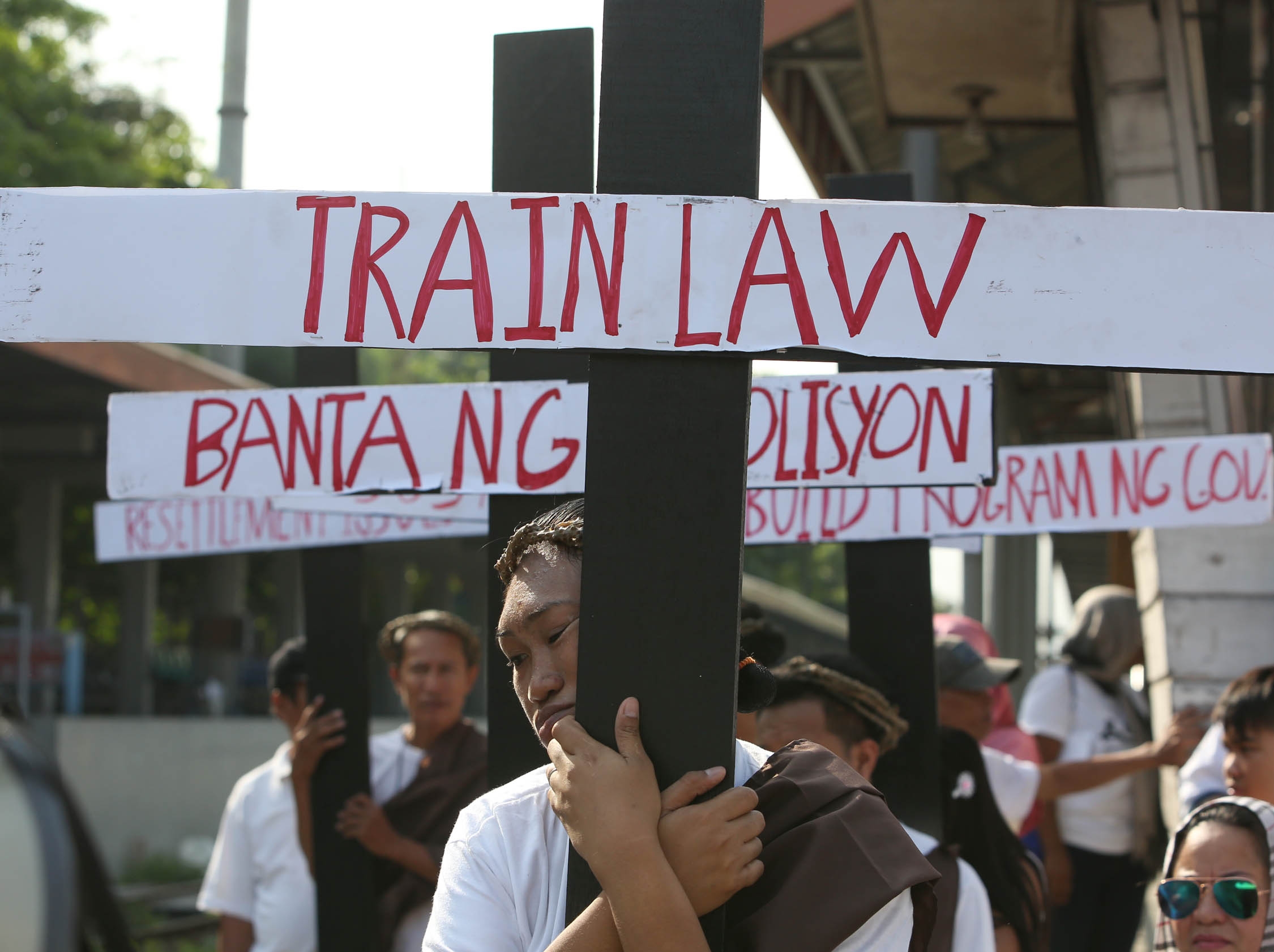

Labor groups expect more workers to be laid off due to TRAIN Act

ADVERSE EFFECTS OF NEW TAX LAW More than 15.6 million workers in the informal sector suffer more from higher prices due to the TRAIN Act, as they do not benefit from the personal income tax exemption enjoyed by those earning P250,000 yearly, according to the Associated Labor Unions-Trade Union Congress of the Philippines. —MARIANNE BERMUDEZ

Like any parent, Maria wants nothing but the best for her children, especially when it comes to education.

She and her husband had been planning to enroll two of their three kids, aged 11 and 6, to a private school in Ilagan, Isabela province, where the family is based, this coming school year.

“But that would have to take a backseat now. We’ll retain them in the public school,” said Maria, 32.

Her colleague, Conrado Farro Jr., of Roxas, Isabela, is facing a bigger problem.

Apart from having no other option but to transfer his two younger sons to a public school this June, Farro worries more for his eldest son who had been born with cerebral palsy.

Article continues after this advertisement“I may not be able to continue sending him to a special school and support his twice-a-week therapy,” Farro said.

Article continues after this advertisement900 laid off

Farro and Maria are both jobless now. They were among the around 600 employees across the country who were laid off by Coca-Cola Femsa Philippines Inc. last month. The number has grown to 900.

Although the Coca-Cola management claimed the mass layoff was due to an impending restructuring in the bottling company, it earlier indicated that the Tax Reform for Acceleration and Inclusion (TRAIN) Act had something to do with it.

Coke said it was undergoing an “organizational structure assessment due to the recent developments in the beverage industry and in the business landscape as a whole.”

Taking effect in January, the TRAIN Act jacked up or slapped new excise taxes on goods like oil, cigarettes, sugary drinks and vehicles to compensate for the restructured personal income tax regime that raised the tax-exempt cap to an annual salary of P250,000.

Those using caloric and noncaloric sweeteners are slapped an excise rate of P6 a liter while those using high fructose corn syrup are taxed P12 a liter. These cover energy drinks, powdered juice drinks and soft drinks.

Demand down

Josie Garcia, a sari-sari store owner in Bangkal, Makati City, observed a decline in her soft drink sales after the price increase in January.

“Before the price increase, I usually stock up my supplies every other day. But now, my stocks would usually last for three to five days because the demand has gone down,” she said.

Garcia now sells Coke Sakto (200 ml) for P10, up 25 percent from P8; Coke Mismo (250 ml) for P15, up 50 percent from P10; Coke Kasalo (750 ml) for P20, up 33 percent from P15; and Coke 1.5 for P60, up 20 percent from P50.

Her retail price of a 25-gram Tang litro pack has jumped 67 percent to P20.

The affected Coke workers wondered whether the company was really reeling from the impact of the TRAIN law.

“Whatever was added in the tax (rates), that was a (corresponding) price increase by Coca-Cola. It means they just passed it on to the consumers,” said Farro, president of the Ilagan Coca-Cola Plant Sales Offices Sales Force Union.

Farro took a swipe at the firm for apparently hiding under the skirt of the new tax law.

“The Coca-Cola management uses the implementation of the TRAIN for its union-busting, despite having no evidence yet of the decline in sales due to the excise tax on sugary and sweet beverages,” he said.

Outsourcing

Alfredo Marañon, president of the Federation and Cooperation of Cola, Beverage and Allied Industry Unions, said Coca-Cola wanted to reduce the number of workers as their jobs would be transferred to third-party providers.

“It’s outsourcing,” he said, as he condemned the firm’s alleged union-busting and collective bargaining agreement violations.

He said some of those affected by the layoffs were officers of unions. He added that employees were not properly notified or consulted about the situation.

Marañon, who was not included in the group of Coke employees laid off in March, said he wouldn’t be surprised if he would soon suffer the fate of Farro and Maria.

According to him, from around 600 in March, the number of employees laid off by Coke has reached around 900.

“The initial 600 were mostly involved in sales. But the displacement has also affected employees involved in operations and other divisions,” Marañon said.

“From what we’ve heard, the company’s target is to get rid of 35 percent of the total work force nationwide. So that’s around 3,500 since Coke has more or less 10,000 employees,” he said.

For the Department of Labor and Employment, it is too early to blame the TRAIN law for the layoffs.

Labor Undersecretary Joel Maglunsod said the department had yet to record any incident of displacement attributed to the new tax law.

He said the Coca-Cola management was outsourcing its sales department to a third-party service provider as part of its attempt to change its business model.

Maglunsod, however, assured the public that the labor department was monitoring the impact of the TRAIN law amid concerns it would be used for retrenching workers illegally.

He also said that employers exploiting the TRAIN law would face sanctions.

‘Convenient excuse’

But labor groups believed that the TRAIN law was being used as a convenient excuse to lay off workers.

“Coke is saying it is being negatively impacted by the new tax on sugar as a result of the TRAIN law, but it seems they are only using it as an excuse to downsize their manpower as part of its corporate restructuring,” said Julius Cainglet of the Federation of Free Workers.

“Oil companies did not lay off workers despite the spate of increases in taxes on their products,” Cainglet noted.

But Luis Manuel Corral, vice president of the Trade Union Congress of the Philippines (TUCP), said he expected similar displacements in other industries.

Purchasing power eroded

Alan Tanjusay, spokesperson for the Associated Labor Unions-Trade Union Congress of the Philippines (ALU-TUCP), said the purchasing power of the minimum wage earners also had dropped across the country as prices of goods and services went up from January to April.

“Even if both parents in a family work, their minimum wage is still not enough to sustain a family of five. A family of five needs at least P1,200 a day to live decently,” he added.

The daily minimum wage is P512 in Metro Manila and the floor pay is lower in other parts of the country.

Tanjusay said informal sector workers would be worse off under the TRAIN law because they would be made to pay more for goods and services without earning extra from adjusted income tax exemptions.

ALU-TUCP expressed concern over the government’s inadequate response to prevent a larger segment of workers from falling into deeper poverty in light of rising prices caused by the TRAIN law.

Tanjusay said the Department of Trade and Industry’s efforts to crackdown on profiteering activities and attempts to ensure affordable basic commodities in the light of rising prices caused by the TRAIN law were temporary and short-lived.

Biggest TRAIN losers

Apart from displaced workers, minimum wage earners and workers in the informal sector are losing out the most from the TRAIN law.

ALU-TUCP warned that over 15.6 million workers in the informal sector would suffer from the implementation of the tax measure.

Workers in the informal economy include independent, self-employed, small-scale producers, and distributors of goods and services, who are not covered by labor laws and have no social protection.

They also include jeepney, tricycle, pedicab and taxi drivers, vendors, sales attendants, barbers, cooks, waiters, dishwashers in eateries and canteens, tailors, sewers and porters.

Ofelia Bonifacio, a rag maker and rice cake vendor from Bagong Silang, Caloocan City, complained that higher prices of goods had reduced her earnings.

Before the TRAIN law, Bonifacio said she took home at least P350 daily. Now, she’s lucky to earn around P150 to P200 due to higher cost of materials she uses in making rags and the sugar and rice for her rice cakes.

She lamented that she could not raise her prices because no one would buy from her anymore.

Like Bonifacio, Dante, a juice and squid balls vendor in Bangkal, Makati, claimed that his income has gone down as he had to shell out more money for capital.

He said he was left with no choice but to pass on the additional cost to his costumers to cope with higher prices and keep his business afloat.

Subsidy stopped

ALU-TUCP also chided the Department of Social Welfare and Development for its apparent sloppy implementation of the P200 monthly subsidy as part of amelioration program for poor families hit by rising prices.

“We received feedback from [some] communities saying that the subsidy has stopped after February,” Tanjusay said.

ALU-TUCP also reproached the Department of Energy for discontinuing the TRAIN-mandated fuel subsidy for jeepney drivers affected by the increase in the excise on fuel.

Maglunsod said TRAIN-affected workers could avail themselves of emergency employment or livelihood aid under the Tulong Panghanapbuhay sa ating Disadvantaged/Displaced Workers Program in regional offices of the labor department.