The local stock barometer pulled back to the 7,500 level on Wednesday, weighed down by local currency jitters and the downturn across US and regional markets.

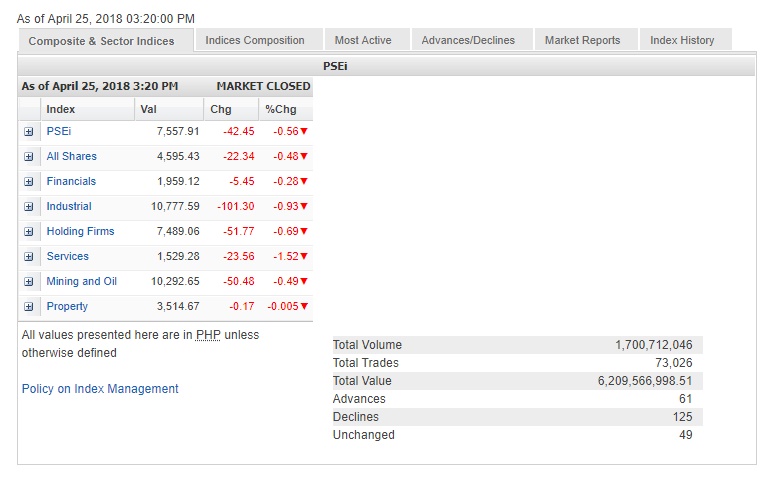

Erasing early gains, the main-share Philippine Stock Exchange index (PSEi) declined by 42.45 points or 0.56 percent to close at 7,557.91.

“The index could be up for challenging days ahead on the back of two overhanging concerns : A weak peso and a drop in the US markets (Tuesday) night,” local stockbrokerage Papa Securities said.

Citing technical indicators, Papa Securities said the relative strength index (RSI) remained weak and had yet to reach oversold level.

All counters declined but the most battered was the services counter, which fell by 1.52 percent.

Value turnover amounted to P6.21 billion. There were 125 decliners that edged out 61 advancers while 49 stocks were unchanged.

Foreigners remained net sellers, resulting in P370.53 million outflows.

The PSEi was weighed down most by Meralco, which fell by 3.88 percent, while Puregold declined by 2.08 percent.

Jollibee, Robinsons Retail Holdings, SM Investments and Alliance Global Group all slipped by more than 1 percent while Ayala Land, BDO Unibank and Metrobank also declined.

Outside of PSEi stocks, notable decliners included MacroAsia and Bloomberry, which respectively fell by 4.17 percent and 3.97 percent.

On the other hand, SM Prime gained 1.23 percent while Ayala Corp., Metro Pacific and BPI all firmed up.

One notable advancer outside the PSEi was Vitarich, which gained 10 percent. The company is cleaning up its balance sheet through a quasireorganization.