The local stock barometer pulled back to the 7,600 level on Tuesday on interest rate jitters ahead of the upcoming monetary policy meetings of the Philippine and US central banks.

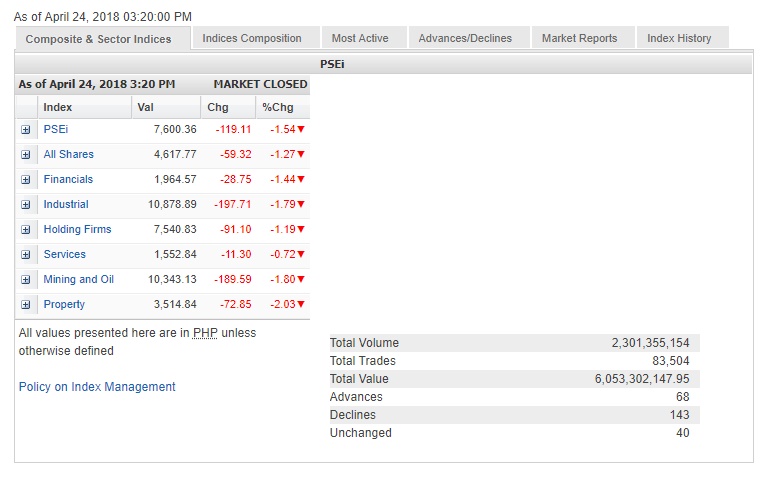

The main-share Philippine Stock Exchange index shed 119.11 points or 1.54 percent to close at 7,600.36 while regional markets were mixed.

At the local market, all counters ended in the red, led by the interest rate-sensitive property counter that fell by 2.03 percent. The financial, industrial, holding firm and mining/oil counters all slipped by over 1 percent.

Value turnover for the day was thin at P6 billion. There were 143 decliners that overwhelmed 68 advancers while 40 companies were unchanged.

There was net foreign selling of P175 million for the day.

The low volume that the market was seeing could be due to investors waiting on the sidelines for further signs on the Bangko Sentral ng Pilipinas’ policymaking meeting on May 10, said local stock brokerage Papa Securities. This was “more so that BSP has still been exhibiting dovish signals despite continued weakness in the stock market and currency,” the brokerage said.

Another key event to watch for is the May 2 US Federal Reserve meeting. The consensus is that the US central bank will keep its interest rates steady but Papa Securities noted that if the US decided to tighten, this might prompt a more aggressive move from the BSP.

“May 4 should also be a date to look for as this is when April’s inflation figure is set to come out; a figure like March’s 4.3 percent (which beat consensus of 4.2 percent) might pressure the central bank to finally hike in their meeting,” Papa Securities said.

The PSEi was dragged down by Jollibee, which fell by 3.06 percent while Ayala Land lost 2.91 percent. URC and SM Prime both shed over 2 percent.

Ayala Corp., SM Investments, Globe Telecom and Metro Pacific all slipped by over 1 percent while BDO, Metrobank, JG Summit, RLC and Security Bank all declined.