The local stock market tumbled sharply on Thursday, underperforming regional markets, as investors dumped equities due to escalating concerns over local economic “overheating” risks and the US-China trade war.

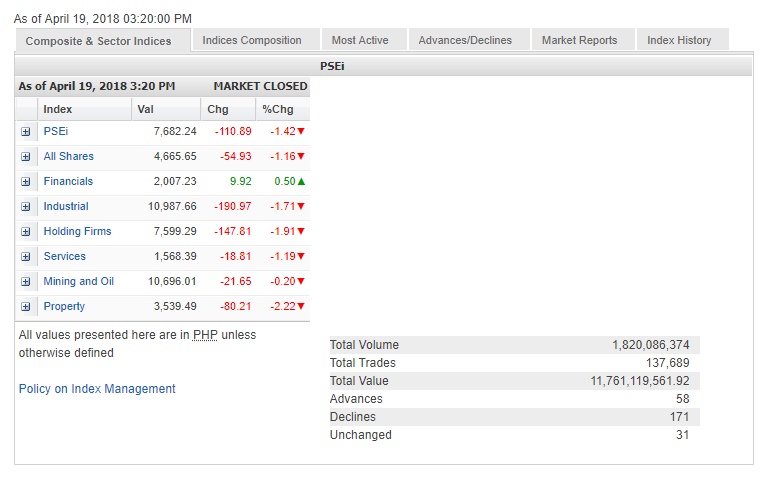

The main-share Philippine Stock Exchange index (PSEi) fell by 110.89 points or 1.42 percent to close at 7,682.24, bucking mostly upbeat regional markets.

The index slid by as much as 255.71 points or 3.3 percent in intraday trade but pared losses as the decline attracted some bargain-hunters.

Foreign investor sentiment was weak, as indicated by the P2.66-billion net foreign selling during the day.

The PSEi has now pulled back by 1,396.13 points or 15 percent from the all-time high peak of 9,078.37 touched on Jan. 29.

The PSEi’s decline was led by the property counter, which fell by 2.22 percent while the industrial, holding firm and services counters all slipped by over 1 percent.

Only the financial counter firmed up (+0.5 percent) as higher interest rates typically benefit banks in terms of improving net interest margins. Shares of BPI surged by 4.81 percent while Metrobank added 1.27 percent.

Joseph Roxas, president of local stock brokerage Eagle Equities Inc., said concerns over economic overheating risks flagged by the World Bank escalated on news that rice and chicken prices were on the rise. This meant that inflation may further creep up, he said.

Jonathan Ravelas, chief strategist at BDO Unibank, said concerns were rising that the weaker peso and higher inflation would hurt consumer spending, and these had overshadowed optimism on additional disposable income released by the recent tax reform program.

At the same time, Ravelas said the “brewing trade war between the US and China have increased investor caution on the markets.”

The next support major level is at 7,000 but based on Thursday’s trading activity, bargain-hunting increases at the 7,500 level.

Value turnover for the day amounted to P11.76 billion. There were nearly thrice as many decliners (171) as advancers (58).

The PSEi was weighed down most by tycoon Andrew Tan-led companies AGI and Megaworld, which both slid by over 4 percent.

Investors also dumped shares of Jollibee, JG Summit, PLDT and GT Capital, which all tumbled by over 3 percent.

Ayala Land, SM Prime, BDO and SM Investments all fell by over 2 percent while URC, AEV, ICTSI and Security Bank all fell by over 1 percent.

Ayala Corp. and Metro Pacific Investments also slipped.

Outside the PSEi, investors also sold down shares of CIC and Vitarich, which fell by 4.17 percent and 3.49 percent, respectively.