Nowadays, a lot of listed companies are choosing to raise capital through a rights offering. As of this writing, there are six companies that have already conducted or are planning to conduct rights offering this year. Using the definition provided by Investopedia, a rights offering is an issue of rights to existing shareholders that entitle them to buy additional shares in proportion to their existing holdings at a predetermined price as of a predetermined date (which is a day before the ex-date). For example, in BPI’s ongoing rights offering, only shareholders of BPI as of April 2, which is a day before its ex-date of April 3, are entitled to buy one share for every 7.0594 shares of the bank that they own at a price of P89.50/share.

Rights shares are attractive because they are usually priced at a discount to the listed company’s market price. For instance, the median discount of the price at which the rights shares can be bought to a predetermined volume weighted average price (VWAP) of the five recently announced right offering is 21.6 percent. Moreover, only the PSE priced its rights shares at a premium to the VWAP. For BPI, the rights shares are priced at P89.50/share, a 21.6-percent discount to its 15-day VWAP. This is also 18 percent below its current market price of P109/share.

There are two reasons you MUST exercise or fully subscribe to your rights shares:

1. To take advantage of the discounted price. As discussed earlier, companies usually price their rights shares at a discount to the market price. By fully subscribing to your rights shares, you are taking advantage of the opportunity to buy the stock below the market price.

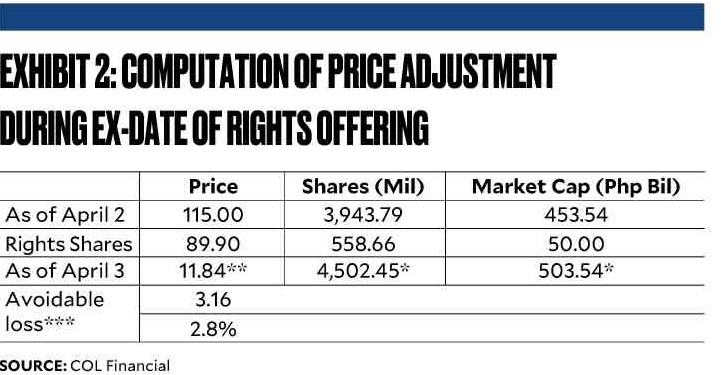

2. To eliminate avoidable losses. Have you noticed that a company’s share price usually opens much weaker on the ex-date of the rights offering? For example, from P115/share as of the close of April 2, 2018, the price of BPI opened 4.3-percent lower at P110 on April 3. The price drops during the ex-date because the PSE automatically adjusts the price assuming that all shareholders will fully subscribe to their rights. (See Exhibit 2: Computation for the adjustment of the BPI shares) If you don’t exercise your rights, the drop in the share price is already a guaranteed loss. However, that loss is avoidable if you fully subscribe to your rights given the benefit of buying the rights shares below market price. For BPI, the avoidable loss is P3.16/share or 2.8 percent.

*Market cap (as of April 3) = Market cap (as of April 2) + Market cap (Rights Shares)

*Shares (outstanding as of April 3) = Shares (outstanding as of April 2) + Shares (Rights to be offered)

** Price (adjusted for rights as of April 3) = Market cap (as of April 3)/Shares (outstanding as of April 3)

***Avoidable loss = Php115 – Php111.84 = Php3.16 or 2.8%

If you don’t have enough money to fully subscribe to the rights offering or are concerned that your exposure to the stock is already too much, then just sell your mother shares or the shares of the company that you already have in your portfolio. This is because you will still be entitled to buy the discounted rights shares even if you sell your mother shares. For example, assuming that you own 71 shares of BPI and that you are entitled to buy 10 shares at P89.50/share, you can sell 10 shares of BPI today at P109/share to raise the funds need to fully subscribe to the rights offering. After the rights offering, you will still have 71 shares of BPI. In fact, the amount you will raise by selling the 10 shares (10 shares x P109/share = P1,090) will be more than the amount you need to subscribe to the rights (10 shares x P89.50/share = P895).

After reading this article, I hope that I have convinced you to go out and exercise your stock rights.