The local stock barometer started the week on a sluggish note, defying mostly firmer regional markets, as investors sought catalysts to load up on stocks.

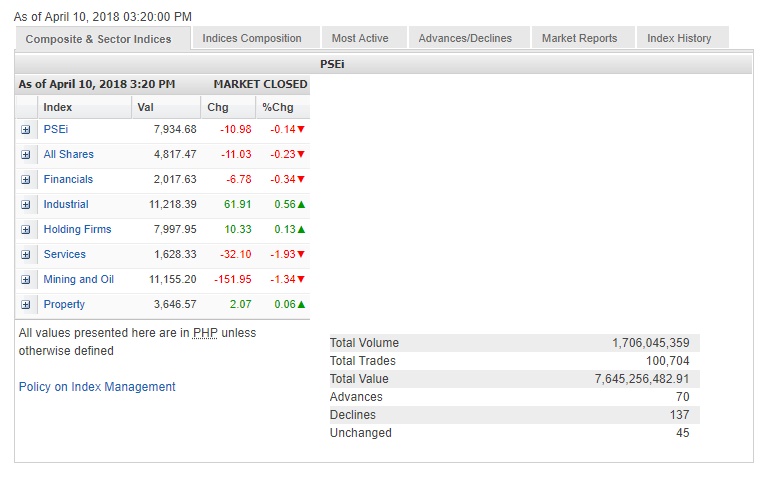

The main-share Philippine Stock Exchange index (PSEi) shed 10.98 points or 0.14 percent to close yesterday at 7,934.68.

The PSEi was weighed down most by the services and mining/oil counters, which both slid by more than 1 percent while the financial counter also slipped.

The industrial, holding firm and property counters were slightly up.

Local stockbrokerage Papa Securities said technical readings showed that the 8,050 resistance had been a “tough level to beat, coupled with its weakening momentum as shown by RSI (relative strength index).”

Value turnover for the day amounted to P7.64 billion. There were 137 decliners that overwhelmed 70 advancers while 45 stocks were unchanged.

Foreigners remained net sellers, resulting in net outflows of P465.76 million from equities.

The PSEi was weighed down most by GT Capital and PLDT, which both slid by more than 3 percent, while Semirara, BPI and ICTSI all faltered by over 2 percent.

Metro Pacific slipped by 1.15 percent while SM Prime and Metrobank also declined.

Outside of PSEi stocks, one notable decliner was Leisure & Resorts World (LR), which tumbled by 10 percent after President Duterte announced that he would not allow casinos to open in Boracay, which will soon undergo a six-month cleanup and stay closed during that period.

On the other hand, Ayala Corp. and Jollibee gained 2 percent while BDO and JG Summit added more than 1 percent.

Ayala Land, SM Investments and Meralco all firmed up.

Notable gainers outside the PSEi included Vitarich, which surged by 11.59 percent, while PXP added 3.32 percent.