The local stock barometer slipped below the 8,000-mark on Thursday as the brewing US-China trade war spooked regional markets.

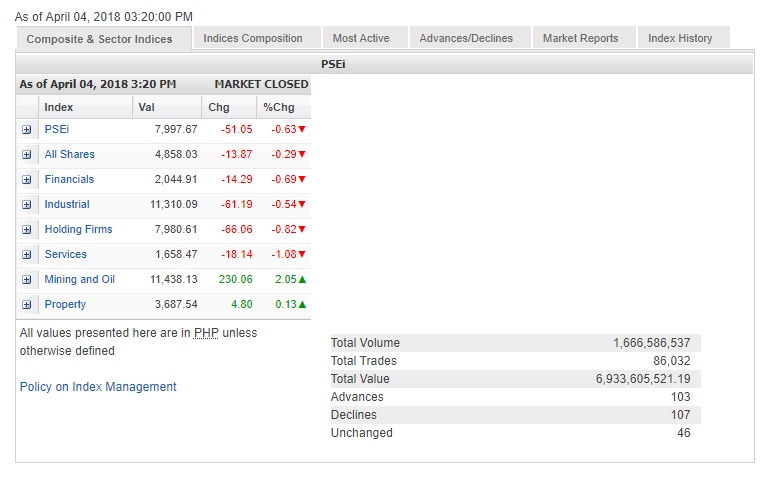

The main-share Philippine Stock Exchange index (PSEi) shed 51.05 points or 0.63 percent to close at 7,997.67.

The most battered index stock was Jollibee, which fell by 3.85 percent following reports that the fast-food giant was ordered by the Department of Labor and Employment to regularize thousands of casual employees.

By counter, the market was dragged down by services, which fell by 1.08 percent, while the financial, industrial and holding firms also slipped.

On the other hand, the mining/oil counter gained 2.05 percent, while the property counter also firmed up ahead of the release of the country’s inflation numbers for February.

Total value turnover was still thin at P6.93 billion. There were 107 decliners that outnumbered 103 advancers while 46 stocks were unchanged.

Foreign investors were net buyers, resulting in modest net inflows of P57.46 million for the day.

Aside from Jollibee, JG Summit took a beating, declining by 2.55 percent.

SM Investments, BDO and LT Group all lost more than 1 percent while Ayala Corp., Metrobank and Metro Pacific also slipped.

Outside of PSEi stocks, one notable decliner was Bloomberry, which fell by 4.2 percent. Bloomberry has been buying back shares to cover the total number of shares granted to certain officers and employees under the Stock Incentive Plan (SIP). The maximum number of shares for the share buyback program has been increased to 51.5 million shares.

On the other hand, shares of Semirara rose 3.96 percent as it won with finality at the Supreme Court a tax dispute with the Bureau of Internal Revenue.

URC added 1.01 percent while Security Bank and PLDT also firmed up.

Stock pundits bought shares of companies outside the PSEi. Vulcan surged 15 percent while MRC advanced by 11.67 percent. FNI jumped by 5.33 percent. Its subsidiary PGMC has signed a supply contract for the delivery of two million metric tons of nickel ore to Baosteel Resources.