Asean agri value-adding: How the Philippines fares

How competitive is Philippine agriculture and agri-industry value-adding?

This article will focus on sector “trade openness,” especially on agriculture and processed food and beverage output sold overseas.

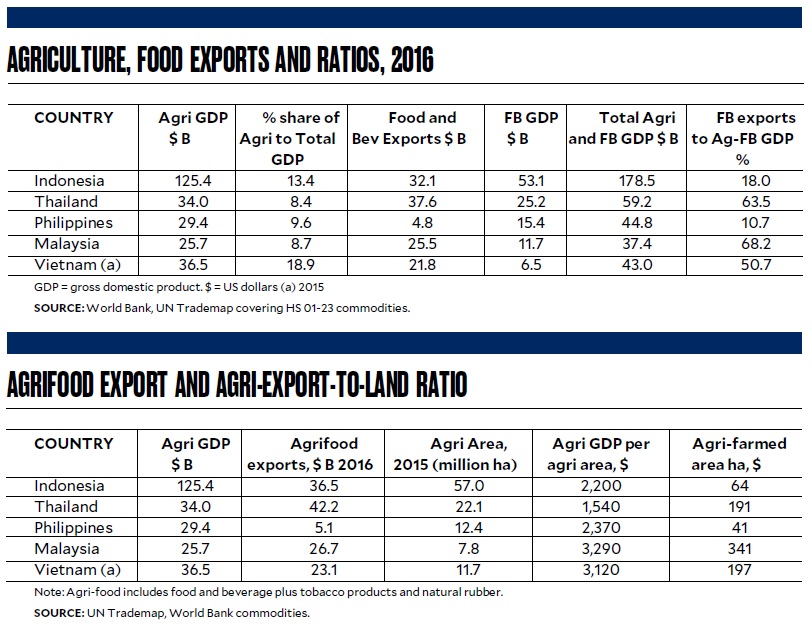

In 2016, the Philippines had an agriculture gross domestic product (GDP) of $29.4 billion, higher than Malaysia but lower than those of Indonesia, Thailand and Vietnam.

In food and beverage manufacturing output, the Philippines ranked third after Indonesia and Thailand.

Two metrics will be discussed in this article:

1. Agrifood export to agriculture and food and beverage (AFB) processing output

Article continues after this advertisement2. Agrifood export to agricultural land

Article continues after this advertisementThe Philippines underperforms in food and beverage exports relative to its peers.

In 2016, Philippine FB export reached only $4.8 billion, far below Thailand’s, Indonesia’s, Malaysia’s and Vietnam’s.

A telling measure is how much of the AFB are exported. The ratio of FB exports to total output in AFB tells that story.

The Philippines is basically domestic-oriented in contrast to its Asean peers.

In 2016, only 10.7 percent of Philippine AFB production was exported as compared to Indonesia’s 18 percent, Vietnam’s 50.7 percent, Thailand’s 63.5 percent and Malaysia’s 68.2 percent.

On agrifood export to land area, the Philippines posted the lowest ratio of $41 per hectare, lower than Indonesia’s $64 per hectare. Outstanding were: Thailand, $191; Vietnam, $197; and Malaysia, $341.

Why is Philippine performance in value-adding lackluster?

1. The Philippines is heavily oriented towards the domestic market where there are “natural” and tariff protections. “Natural” protection covers the cost of logistics among islands and the low scale of importable goods.

2. Its export base is narrow, with heavy reliance on coconut products and bananas. That is only two $500-million exports versus seven for Malaysia, nine for Vietnam, 10 for Indonesia and 17 for Thailand.

3. The low export is also a result of long-term lack of sustained support for crop, livestock and fishery diversification resulting in low productivity and limited investments.

4. The land reform law is not helping either. The limits of land ownership as well as land rental market discourage private investments and economies of scale.

5. Relatedly, lack of private investments in agriculture results in inadequate supply of managerial skills, and, in turn, uncompetitive agriculture.

There is mistaken notion that agriculture development and rural poverty reduction are the sole responsibility of the Department of Agriculture.

Agriculture development that will reduce rural poverty entails coordinated efforts of many actors in the public sector (national government, local government), the private sector and civil society.