Local stocks fell below the 8,000 mark anew on Friday as a brewing US-China trade war spooked global markets.

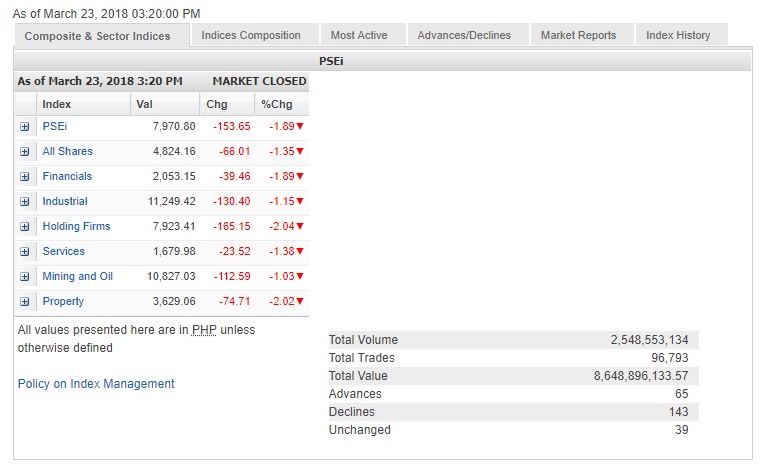

The main-share Philippine Stock Exchange index (PSEi) tumbled by 153.65 points or 1.89 percent to close at 7,970.80. About P1 billion worth of foreign funds exited the stock market during the day.

For the week, the PSEi shed a total of 267.35 points or 3.24 percent.

“The looming trade war triggered investors to run for the shelters. The smell of gunpowder is getting stronger,” said Astro del Castillo, managing director at fund management firm First Grade Finance Corp. “The consequences will not be good for the global economy.”

US President Donald Trump ordered tariffs on Chinese imports worth $50 billion and announced fresh investment restrictions on Chinese companies. China immediately retaliated by announcing a plan to impose a 25-percent tariff on US pork imports and recycled aluminum alongside a 15-percent tariff on American steel, pipes, fruit and wine.

“The long break next week is not helping as well. It is forcing many to stay out of the market for the meantime,” Del Castillo said, referring to the coming shortened trading week in observance of the Holy Week.

All counters ended in the red but the most battered were the holding firm and property counters, which both faltered by over 2 percent.

Value turnover for the day amounted to P8.65 billion. There were 143 decliners that overwhelmed 65 advancers while 39 stocks were unchanged.

The PSEi was weighed down most by Ayala Land, SM Investments and GT Capital, which all lost 3 percent of their value.

Outside of the PSEi, notable decliners included Now Corp. and Pilipinas Shell, which both tumbled by over 9 percent, while MRC Allied slid by 6.25 percent. PXP Energy also fell by 3.62 percent.

Jollibee bucked the day’s downturn, gaining 0.42 percent.