The local stock barometer yesterday fell below the critical 8,000 barrier for the first time this year as foreign funds continued to dump local equities as part of portfolio rebalancing.

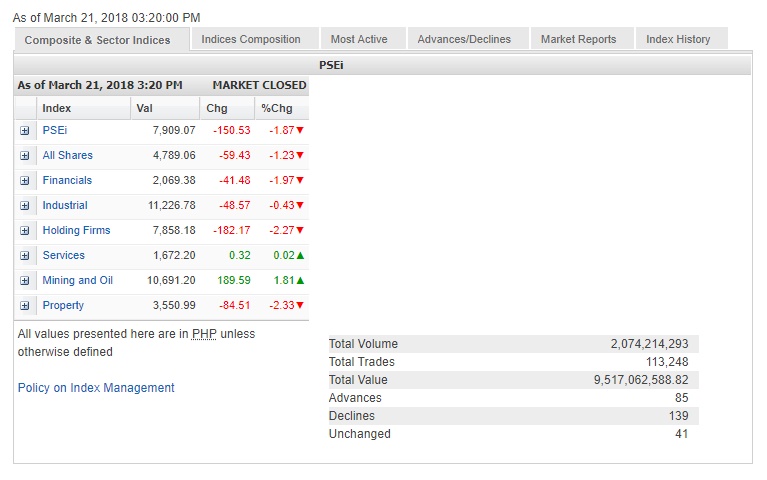

The main-share Philippine Stock Exchange index (PSEi) shed 150.53 points or 1.87 percent to close at a seven-month low of 7,909.07, underperforming regional markets as P1.51 billion worth of foreign funds flowed out the local market for the day.

This was the lowest finish seen by the PSEi since Aug. 3, 2017, when it closed at 7,876.66.

Since peaking at 9,078.37 on Jan. 29, the main index has pulled back by 1,169.3 points or 14.8 percent. A decline of at least 10 percent is seen as a correction phase.

“I think this is still part of the MSCI Asia ex-Japan rebalancing where Philippines is downweighted due to inclusion of China,” said First Metro Asset Management Inc. president Gus Cosio.

But with market valuations no longer expensive at 17 times expected earnings for this year, Cosio said it would be a good time to take the plunge.

Investors are likewise jittery ahead of the Bangko Sentral ng Pilipinas (BSP) policy meeting on Thursday.

“Looking forward, the market could already be starting to fully discount the BSP’s decision in its monetary setting. With this, the market might finally see a reprieve once the Monetary Board provides clarity. Quarter-end window dressing will also aid in the index’s possible recovery,” local stock brokerage Papa Securities said.

The next support level for the PSEi is at 7,800, it said.

Holding firms and property counters were the most battered indices, both falling by over 2 percent.

The financial counter fell by 1.97 percent while the industrial counter also slipped.

On the other hand, the mining/oil index gained 1.81 percent while the services counter was slightly higher.

Value turnover for the day hit P9.52 billion. There were 139 decliners, 85 advancers and 41 stocks unchanged.

The PSEi was weighed down most by Metro Pacific, which slid by 4 percent, while Ayala Land, BPI and GT Capital all shed over 3 percent.

BDO, Ayala Corp. and SM Prime all lost over 2 percent while Metrobank, SM Investments, JG Summit and Megaworld slipped by over 1 percent. URC and Jollibee also declined.

PLDT bucked the day’s downturn with its modest gain of 0.62 percent.