The local stock market officially entered the correction phase on Tuesday, with the index losing over 10 percent of its value from the recent peak, as an overnight bloodbath in Wall Street unnerved investors.

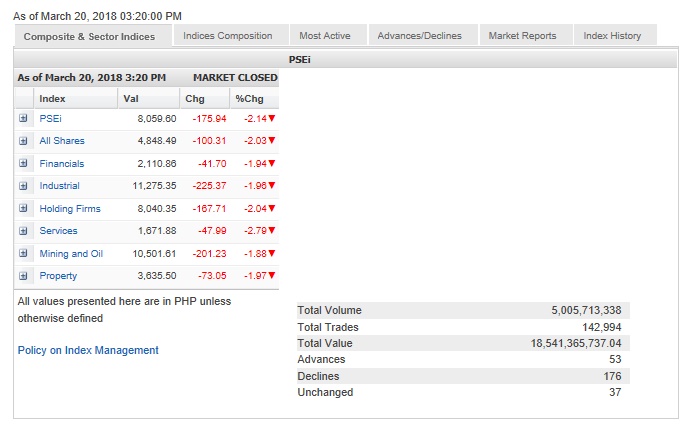

The main-share Philippine Stock Exchange index (PSEi) slid by 175.94 points or 2.14 percent to close at 8,059.60, its weakest finish for this year.

The PSEi has now fallen by 1,018.77 or 11.22 percent from the historic high seen early in the year.

“Philippine stocks entered a correction phase as they fell 10 percent from the 9,078 top,” said BDO Unibank chief strategist Jonathan Ravelas said.

Ravelas said there was still a strong support level at 8,000, previously a resistance that took three years for the market to break out of.

“Break below said levels could challenge 7,500 to 7,800 levels,” he said.

A support level at 8,050 was breached in intra-day trade. The index bottomed out at 8,015.49 for the day.

All counters fell but the day’s most battered were the holding firm and services counters, which both tumbled by over 2 percent.

The financial, industrial, mining/oil and property counters all lost over 1 percent.

Value turnover was high at P18.54 billion.

There was a P7.94-billion block sale on Ayala Corp. as Japanese trading giant Mitsubishi sold around 8.5 million shares at P934 each.

Net foreign selling amounted to P3.83 billion, the heaviest in a single day in recent history.

There were over thrice as many decliners (176) as advancers (53) while 37 stocks were unchanged.

The PSEi was weighed down by Ayala Corp., which slid by 7.23 percent after a discounted share-sale by Mitsubishi Corp. of Japan.

Jollibee also lost 4 percent while PLDT and ICTSI both declined by over 3 percent.

BDO, Metrobank and SM Prime all shed over 2 percent while Ayala Land and Metro Pacific lost over 1 percent.

JG Summit and URC also contributed to the day’s decline.

Meanwhile, SM Investments —the most valuable company in the local stock market with a market cap of over P1.1 trillion —bucked the day’s downturn, adding 0.9 percent.

Investors also picked up shares of Now (+2.33 percent) and MRC Allied (+16.07 percent) on the back of a third telco speculative play.