Most of us could use the extra cash to fulfill a life goal—starting a small business, paying for graduate studies, funding that dream vacation—but are too wary of increasing our debt to even consider taking out a personal loan. But if you’re going to use that money to invest in something that will improve your way of life and you have the means to pay, should you really be so concerned about owing money?

In a lot of ways, taking out a personal loan could actually help you get your finances in order. Sure, it’s something else that you have to pay for. But wise spending is not just about how much money you expend or save. It’s also about how you choose what you spend on. If you’re renting out an apartment, for example, you can get a loan to pay the down payment for a condo or a house instead. That way, your money actually goes somewhere; you are investing in your own property instead of just watching your rent money go down the drain every month.

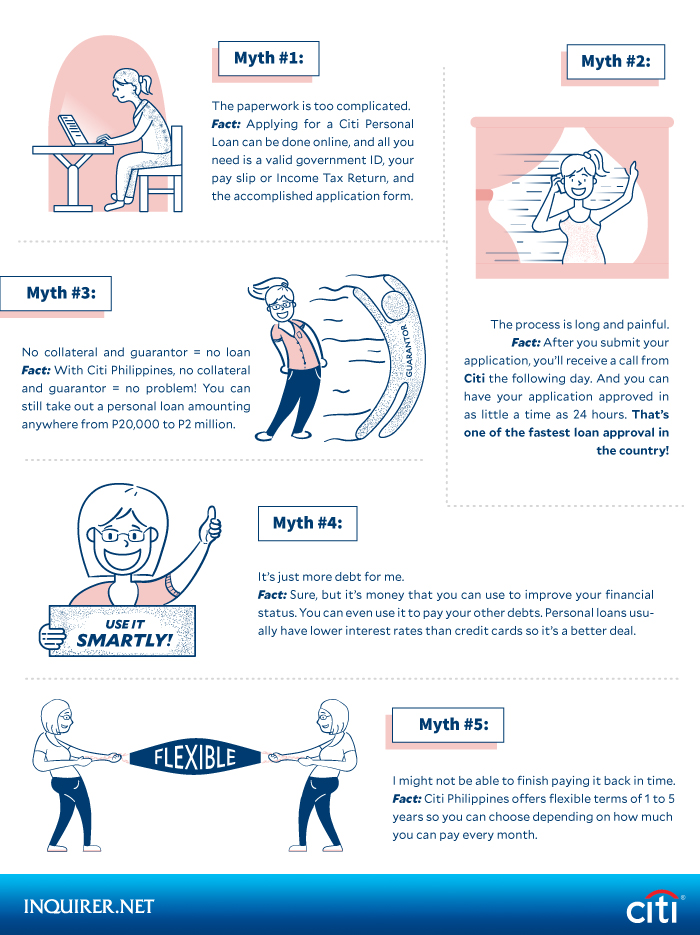

Personal loans are a great way to supplement your income in order to get a leg up in life. And who doesn’t want that? It may sound like a big responsibility to take on, but with discipline and careful planning, you’re sure to get the most out of your loan. If you’re still a little on the fence about taking it, here are five popular myths about personal loans that we debunked for you.

Apply for a Citi Personal Loan today– the loan with the fastest approval in the country! Submit your application online and get approved in as fast as 24 hours! Visit their website to learn more. INQUIRER.net/PAR