Market slips by 0.4% on thin trade

The local stock barometer yesterday slipped as investors braced for an upcoming US inflation data, which will provide clues on the pace of the US Federal Reserve’s monetary tightening.

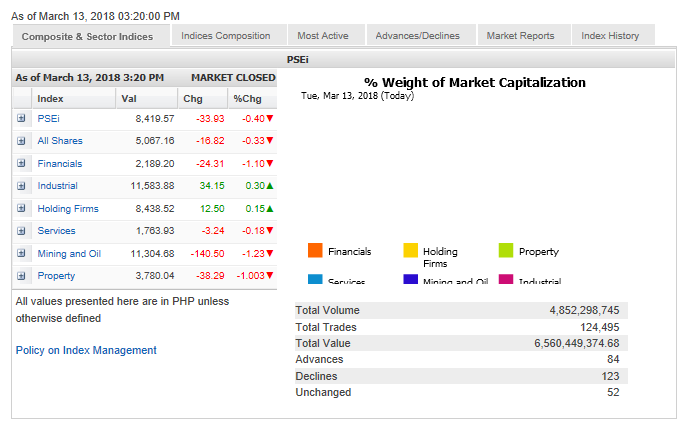

The main-share Philippine Stock Exchange index shed 33.93 points or 0.4 percent to close at 8,419.57.

The market was dragged down most by the financial, mining/oil and property counters which all fell by over 1 percent. The services counter was also slightly lower.

On the other hand, the industrial and holding firm counters firmed up.

Value turnover for the day was thin at P6.56 billion. There was net foreign selling amounting to P480.8 million for the day. The PSE has seen net foreign outflows in the last three weeks.

Article continues after this advertisementThere were 123 decliners that edged out 84 advancers while 52 stocks were unchanged.

Article continues after this advertisementThe PSEi was weighed down most by banking giant BDO, which fell by 2.48 percent, while property giants Ayala Land and SM Prime lost 1.07 percent and 1.92 percent, respectively.

SM Investments, Metrobank, Jollibee and Security Bank also slipped.

There was likewise selling on shares of second- and third-liner stocks that had surged in previous days.

PXP Energy, a beneficiary of a Philippine-China joint oil exploration play, slid by 7.18 percent.

MRC Allied, indirectly linked to a third telco player, was the day’s most actively traded company. Its share price pulled back by 4.49 percent.

The PSEi’s decline was tempered by the 2-percent gain of Aboitiz Power. Metro Pacific and JG Summit both rose by over 1 percent while DMCI also firmed up.

Outside PSEi stocks, Pacific Online gained 15.5 percent while DoubleDragon Properties added 4.57 percent.

DoubleDragon, which recently submitted an amended offering prospectus, intends to sell up to 135 million common shares, with an over allotment option for another 15 million common shares at up to P50 per share. The timing and size of the offer will be subject to the release of regulatory approvals.

EDC gained 1.18 percent.