RCBC sees 5-10% profit growth on strong lending business

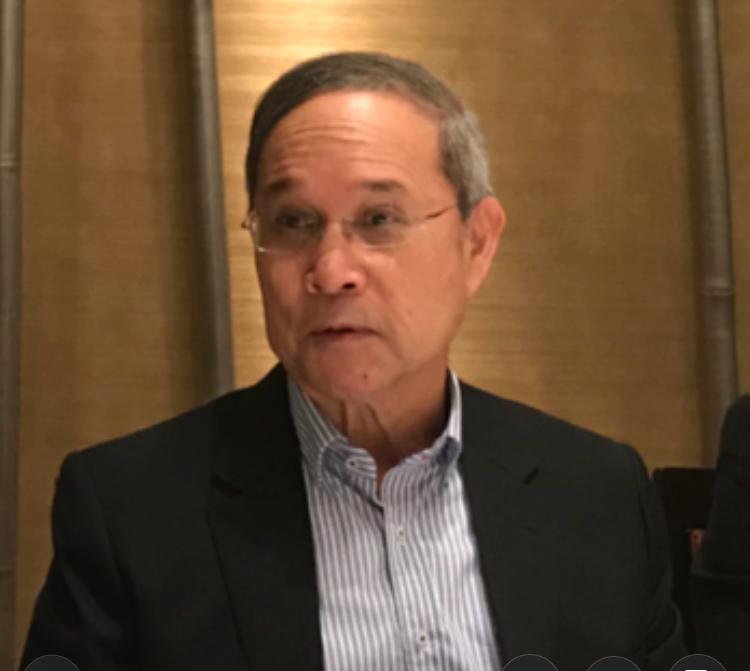

RCBC president Gil Buenaventura

Yuchengco-led Rizal Commercial Banking Corp. (RCBC) expects to grow its net profit this year by 5 to 10 percent from last year’s level on higher lending activities to productive sectors of the domestic economy.

Thrift bank subsidiary RCBC Savings Bank, for its part, sees double-digit growth in profit this year.

RCBC grew its net profit last year by 11.4 percent to P4.3 billion. RCBC Savings, on the other hand, posted a net profit of P1.35 billion, 34 percent higher than the previous year.

“We’d like it to be higher but we recognize it’s going to be a competitive landscape among the players so 5-10 percent is a good number,” RCBC president Gil Buenaventura said in a briefing on Friday, when asked about the bank’s profit growth guidance for 2018.

“Our growth will be more on the lending side. We’ll target higher-margin sectors primarily consumer lending—credit cards—as well as SMEs (small and medium enterprises). Corporates will be opportunistic. We really won’t be earning a lot on the loan side but earn more on the fee side in corporate finance,” Buenaventura said.

This year, RCBC expects to expand its loan book by 18 percent, likely driven by growth across all sectors and in line with the high-teen industry-wide loan growth trend, said Chrissy Alvarez, head of RCBC corporate planning.

Asked about how RCBC had gone so far in the year, Buenaventura said the bank was “tracking the budget.”

“The first month was okay. The second month, being a shorter month (February) was not so good, but first quarter numbers should be okay vis-a-vis same period last year,” Buenaventura said.

RCBC expects to maintain a net income margin of at least 4 percent this year. Typically, rising interest rates result in improving margins as cost of deposits does not immediately catch up with the rise in lending rates.

By June this year, RCBC plans to raise P15 billion from a stock rights offering, proceeds from which will fund loan expansion in the next two to three years.

For its part, RCBC Savings, the third largest savings bank in the country, expects to grow its net profit and loan book by double-digit levels this year.

“We continue to be optimistic as far as market prospects are concerned,” RCBC Savings Rommel Latinazo said.

But Latinazo said RCBC Savings would have to be a bit conservative given that the local automotive industry was projecting flat car sales this year coming from last year. In 2017, car sales hit record levels ahead of the legislation of the tax reform program that jacked up excise taxes on in the country vehicles.

“We have a pretty good coverage of the market,” he said.

“Last year, net income increased by 13 percent, so you should be hitting along that number this year, if not for the conservative forecast of the auto industry,” he added.

With P117 billion in resources, about 96 percent of RCBC Savings’ balance sheet is made up of auto loans and housing loans.

RCBC Savings president Rommel Latinazo