DMCI nets P14.8B

Consunji-led engineering conglomerate DMCI Holdings grew its net profit last year by 16 percent to P14.8 billion on higher earnings from its coal energy, real estate, construction and nickel mining businesses.

DMCI was also able to meet its double-digit profit increase goal despite what was deemed as a “challenging year.”

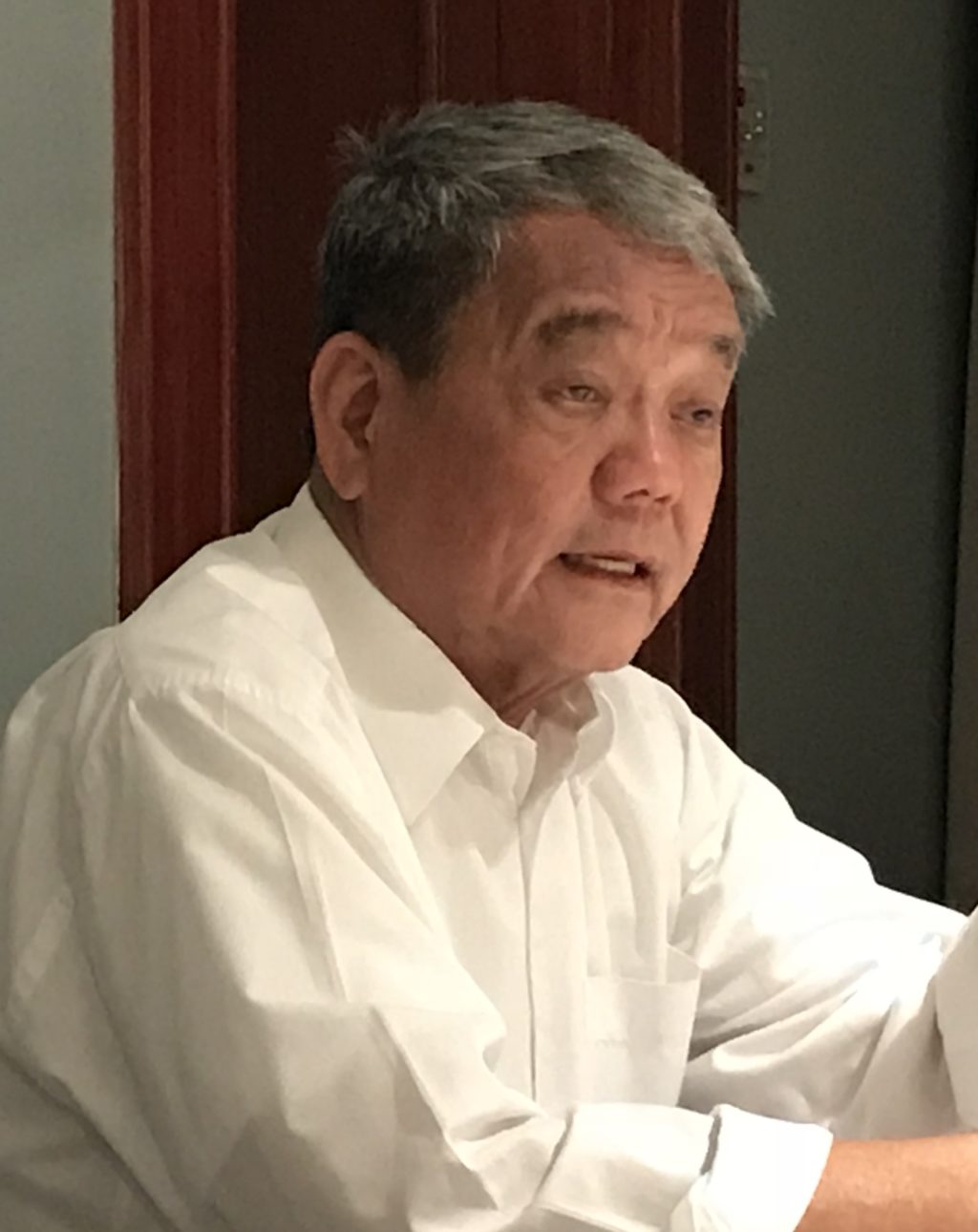

“For 2018, our financial performance will likely be more modest because of tapering electricity rates and the unresolved issues in our nickel mining and water businesses. But we see strong growth from our coal production and real estate segments,” DMCI chair and president Isidro Consunji said.

For the fourth quarter of 2017 alone, DMCI’s net profit rose by 9 percent year-on-year to P3.1 billion on the back of P22 billion revenues, which rose by 5 percent. For the full year, DMCI’s revenues expanded by 18 percent to P81 billion.

Among its operating units, the biggest contributor to DMCI’s net profit last year was Semirara Mining and Power Corp. with a share of 54 percent, followed by the real estate business under DMCI Homes with 24 percent and share of earnings from Maynilad Water Services Inc. which accounted for 11 percent.

Article continues after this advertisementExcluding a one-time gain of P111 million from the sale of its 10-percent stake in Subic Water and Sewerage Co. in 2016, DMCI’s core net profit rose by 17 percent to P14.8 billion last year.

Article continues after this advertisementNet income contribution from Semirara grew by 15 percent last year to P8 billion due to the 20-percent increase in average coal prices and the 21 percent increase in gross electric output.

DMCI Homes, on the other hand, posted a 47-percent increase in net earnings contribution to P3.6 billion from restated earnings of P2.4 billion in 2016. The property developer’s financial results in the prior year were restated to reflect the shift in accounting policy from completed contract method to percentage of completion method, aligning itself with the current accounting practice in the real estate industry.

The construction business under D.M. Consunji Inc. also grew earnings contribution by 11 percent to slightly over P1 billion on lower operating costs, favorable settlement of pending claims and earlier-than-expected completion of some minor projects.

DMCI Mining Corp. returned to profitability last year, earning P113 million compared to a net loss of P65 million in 2016. This turnaround was attributed to a significant drop in operating costs alongside the shipment of 525,000 wet metric tons of nickel ore from its old inventory.

On the other hand, off-grid energy business DMCI Power Corp. ended the year with a 15-percent decline in net profit contribution to P359 million, due primarily to the expiration of income tax holiday for its Masbate operations.

DMCI’s share of earnings from Maynilad also dropped by 12 percent to P1.6 billion due to the delayed implementation of its tariff adjustment alongside a high base in the previous year, during which the water utility posted one-time gain from the re-measurement of its deferred tax liability.