D&L sees double-digit 2018 profit growth

D&L president Alvin Lao discussing 2017 corporate results

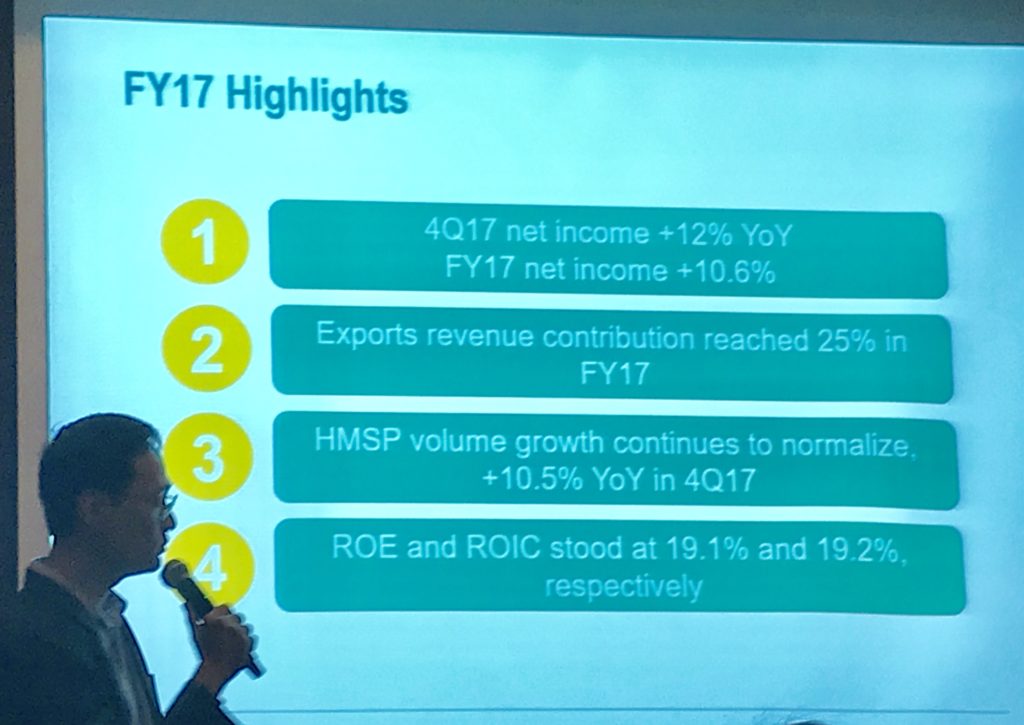

Chemical and food ingredient manufacturer D&L Industries Inc. grew its net profit last year by 10.6 percent to P2.9 billion, a pace of growth seen to be sustained this year on the back of a favorable macroeconomic backdrop.

“We rounded off 2017 with double digit growth, showing full recovery from a tough start to the year,” D&L president and chief executive officer Alvin Lao said. “We see that our full year results better reflect the long-term growth prospects of the business.”

“Going forward, we will continue to exercise discipline and excellence in R&D (research and development) as we continue to target opportunities in the growing Philippine economy, as well as in our rapidly expanding export segments,” Lao said.

For the fourth quarter of 2017 alone, D&L’s net profit grew by 12 percent to P786 million as the company sold 25 percent more products year-on-year amounting P7.84 billion. For the full-year, sales expanded by 25 percent to P27.8 billion.

Last year’s performance translated to a return on equity of 19.1 percent for D&L.

D&L saw a 68-percent increase in export earnings last year to P6.83 billion, accounting for 25 percent of total business, compared to the 18 percent ratio in the previous year. With the company’s partnerships with Ventura and Bunge maintaining pace, the food ingredients segment is now the biggest contributor to exports, contributing 45 percent to total export sales compared with just 19 percent in the previous year.

In a press briefing on Tuesday, Lao said D&L would likely maintain the double-digit earnings growth momentum this 2018 on the back of growing export receipts, improving margins and strong domestic economic environment.

In the first two months of the year, Lao said D&L had seen a lot more optimism among its customer base and rising level of investments is in turn seen to support growth in demand for its products.

Volume growth is a little bit harder to predict this year but Lao said it would likely be closer to the normal growth rate of around 7 percent.

Meanwhile, net income margins narrowed by 1.4 percentage points (ppt) last year to 10.5 percent, largely due to lower commodity margins. But these commodity gross profit margins showed signs of improvement, inching up by 0.9 ppt to 4.8 percent in the fourth quarter from 3.9 percent in the third quarter.

The high-margin speciality products (HMSP) segment accounted for 58 percent of total revenues last year while the remaining 42 percent was accounted for by commodities.

Gross profit margins from the HMSP segment stood at 24.8 percent last year, up by 0.2 ppt.

Net gearing stood at 25 percent of equity, giving D&L leeway to fund expansion plans without having to return to the equities market anytime soon.

Overall utilization for the food ingredients plant now stood at 65 percent. In November 2017, the company announced plans to put up a new food ingredients facility in order to sufficiently serve its growing domestic and export business. The new plant will be located in First Industrial Township, which is a special economic zone in Batangas.

D&L’s business segments performed last year as follows:

– Chemrez grew net profit by 9 percent as robust growth in the high-margin oleochemicals business offset the weakness in biodiesel;

– The specialty plastics group grew net income by 7 percent due to an improved product mix that improved margins, as revenue contribution of colorants and additives exceeded revenue contribution of engineered polymers;

– Aerosols remained the fastest growing segment, rising by 20 percent with blended margins expanding due to the shift to higher-value and more R&D-intensive products.