The local stock barometer traded in the doldrums on Friday as investors across regional markets worried over a trade war that may arise from protectionist US policy pronouncements alongside the hawkish tone of the US Federal Reserve.

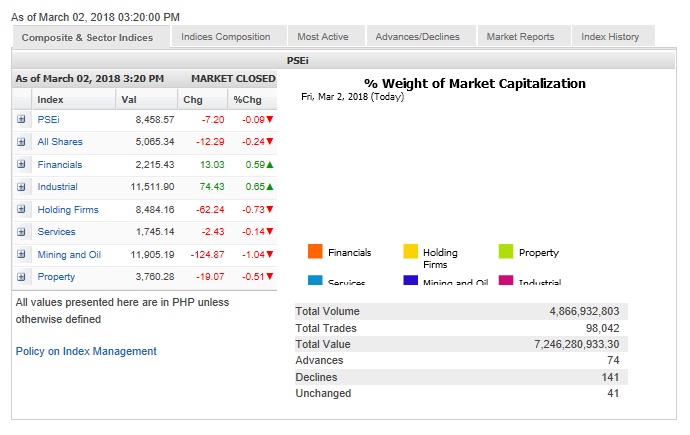

The main-share Philippine Stock Exchange index (PSEi) shed 7.2 points or 0.09 percent to close at 8,458.57.

The PSEi was dragged down most by JG Summit, which fell by 4.99 percent on speculation that the conglomerate would be stricken off the FTSE index.

For the week, the main index lost 8.99 points from last Friday’s closing of 8,467.56.

“Optimism doesn’t look good in these early days of March especially with the Dow’s persistent weakness like its 400-point drop last night,” local stockbrokerage Papa Securities said.

“(Philippine) inflation data is also just around the corner next March 6, Tuesday, so we could hope for a figure that doesn’t stray too far from January’s figure of 4 percent,” the brokerage added.

The January inflation level was at a three-year high and hit the upper end of the inflation-targeting Bangko Sentral ng Pilipinas’ (BSP) 2-4 percent target range.

The local stock barometer fell by as much as 128.08 points or 1.5 percent to bottom out at 8,337.69 in intraday trade but trimmed losses in late trade as bargain-hunters emerged.

Trade war jitters escalated on news that US President Donald Trump was planning to slap tariffs on steel and aluminum, in turn seen to distort global trade and trigger retaliatory measures.

The main index was weighed down most by the mining/oil counter, which fell by 1.04 percent, while the holding firm, services and property counters also slipped.

Value turnover for the day amounted to P7.25 billion. There was net foreign selling amounting to P619.93 million.

There were 141 decliners that overwhelmed 74 advancers while 41 stocks were unchanged.

Aside from JG Summit, Ayala Land’s 1.66-percent decline also affected the PSEi. BPI, Ayala Corp. and Semirara all slipped.

There was also profit-taking on non-PSEi stocks that rose sharply in previous sessions. PXP Energy, which had rallied on a China-Philippines oil exploration play, gave up 4.81 percent, while MacroAsia tumbled by 3.11 percent. Now Corp., a beneficiary of the third telco player play, shed 2.39 percent.

Meanwhile, the PSEi’s decline was tempered by the gain of URC, which added 2.55 percent, while BDO and Metrobank both advanced by more than 1 percent.

SM Prime, Jollibee and Aboitiz Power also firmed up.

Outside the PSEi, investors loaded up on shares of Crown Equities, which surged by 8.2 percent, and MRC Allied, which added 5.48 percent.