Chinese nationals, companies now ALI’s biggest foreign condo buyers

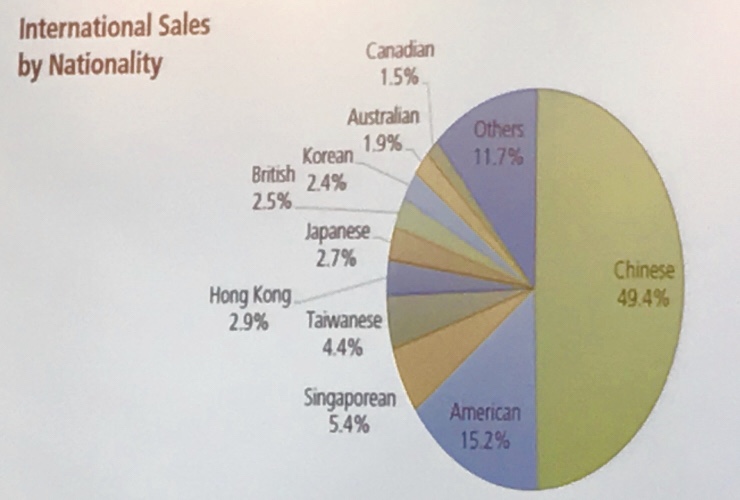

Ayala Land’s chart on international sales

A growing number of investors from mainland China are buying residential condominium units in the Philippines, now a more attractive investment destination for them following the rekindling of diplomatic ties between the two countries.

Based on 2017 data from property giant Ayala Land Inc. (ALI), international sales—referring to combined sales take-up by overseas Filipinos and foreigners—grew by 32 percent last year to P41.6 billion. This accounted for 34 percent of the company’s P122-billion sales take-up for the year.

Foreigners accounted for the bulk of 24.5 percent of ALI’s total sales take-up last year compared to the 9.6 percent share of overseas Filipinos.

Of the foreigners who bought residential condominium units from ALI last year, Chinese nationals accounted for 49.4 percent. This was a marked improvement from their share of about 10 percent in 2016, ALI chief financial officer Augusto Bengzon said in a recent press briefing.

This suggested that Chinese investors bought P14.76 billion worth of residential condominium units from ALI last year, equivalent to 12 percent of total sales take-up reported by the company during the period.

Article continues after this advertisementALI president Bernard Vincent Dy said these Chinese buyers—a mix of individuals and corporate entities—were buying across all brands, primarily in Metro Manila and some in Cebu.

Article continues after this advertisementAsked whether the Chinese buyers were involved in the burgeoning online gaming industry, Dy said: “Majority are not. They really are international investors.”

“You have seen what happened in the last two years with the warming of Chinese-Philippine relations. We see it in office take-up and also in the tourism numbers. We’re also seeing a lot of Chinese investors buy property,” Dy said.

Foreigners are not allowed to own land in the Philippines but they can own condominium units for as long as the property developer does not sell more than 40 percent of the units in a particular development to foreigners.

Next to the Chinese, American investors accounted for the next biggest share of ALI’s sales to foreigners, accounting for 15.2 percent. Singaporean investors had a share of 5.4 percent while Taiwanese investors bought 4.4 percent.

Other key foreign markets and their respective shares are: Hong Kong (2.9 percent); Japanese (2.7 percent); British (2.5 percent); Korean (2.4 percent), Australian (1.9 percent) and Canadian (1.5 percent).

Last year, ALI sold more residential units than it launched. Its P122-billion sales take-up, an indicator of future revenue growth, exceeded the P88.88 billion value of new launches.

In the last two years, the property industry has sold more residential units than those launched in Metro Manila. Based on data from property consulting firm Colliers Philippines, full-year 2017 residential take-up in the metropolis reached 52,600 units—the highest seen since 2012—while only 33,300 new residential units were launched.

“Given the record take-up, it was not surprising to see prices rise to record levels as well. Meanwhile, rents have been declining or flat at best, due to the combined effect of a double-digit vacancy and the influx of new supply. Naturally, residential yields are declining,” Colliers said in its latest research note. —DORIS DUMLAO-ABADILLA