The Philippine Stock Exchange index will likely resume its upswing and reach a new high of 9,100 within this year as the country’s macroeconomic fundamentals remained favorable, the chief strategist of BDO Unibank said.

In a briefing with the Federation of Filipino-Chinese Chambers of Commerce and Industry on Wednesday night, BDO’s Jonathan Ravelas said local equities would have room to gain this year on prospects of higher government spending.

About 70 percent of incremental revenues to be generated by the government from the recent tax reform program are seen going to infrastructure spending.

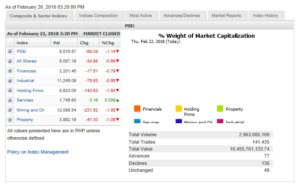

Last year, the PSEi advanced by 25 percent. This year, the index has pulled back from successive all-time highs seen at the beginning of the year, trimming year-to-date gain to only around 1 percent in line with the correction seen in US equities.

“The market is taking a breather mainly because it wants to realize what would be the potential effects of this rising inflation,” Ravelas said.

The PSEi peaked at 9,078.37 in intraday trade of Jan. 29 this year and closed at a record high of 9,058.62 on the same day.

In January, the country’s inflation rate surged to a three-year high of 4 percent and higher than the Bangko Sentral ng Pilipinas (BSP)’s overnight borrowing rate of 3 percent. As such, Ravelas said there was a need for the BSP to raise its official policy rate.

For the full year, BDO expects the BSP’s overnight borrowing rate to rise by a total of 50 basis points to 3.5 percent.

The peso is likewise at risk of probing the 53:$1 level but Ravelas noted that toward the fourth quarter, which is a season of heavy remittance flows, the peso would likely recover to 52:$1.

“I would take this very positively, like a three-day sale at SM, where foreign investors can come in at a lower cost (due to the higher exchange rate),” he said.

But the peso has been weakening because of the importation requirements under the government’s “Build, Build, Build” strategy. “What we’re doing is building for the country’s future, providing infrastructure to be competitive,” he said.

Overall, he said the domestic economy would sustain a growth of 6.8 percent this year on the back of public and private spending.

Despite rising inflation and interest rates, BDO and its partner brokerage house Nomura favor property, industrial and banking sectors.