PSE index reverses early losses, stays above 8,700

The local stock barometer reversed early losses on Tuesday, staying afloat the 8,700 level on selective buying of large-cap stocks.

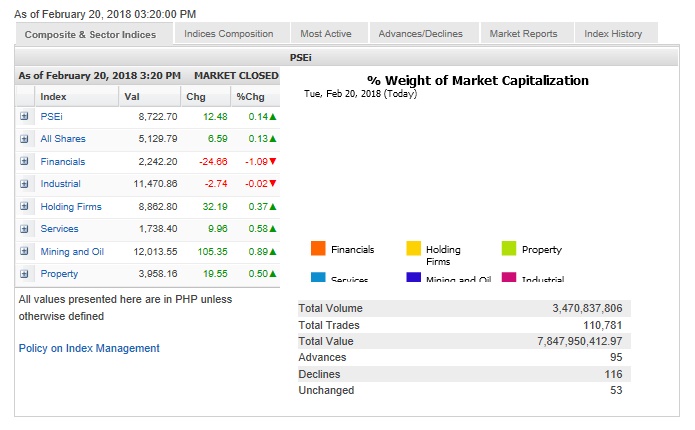

The main-share Philippine Stock Exchange index (PSEi) added 12.48 points or 0.14 percent to close at 8,722.70.

Papa Securities said the PSEi had responded positively to the Bangko Sentral ng Pilipinas’ decision to cut the reserve requirement on banks by one percentage point.

“Although the market seems to be strengthening, we’d still like to remain cautious given that the high volatility in the market has only started to stabilize and possible downturns in the US market,” Papa Securities said.

With the market breaching 8,700, Papa Securities said the next resistance level would be at 8,816.

The PSEi was led higher by the holding firm, services, mining/oil and property counters.

On the other hand, the financial counter fell by 1.09 percent while the industrial counter also slipped.

Value turnover for the day amounted to P7.85 billion. Domestic investors supported the market as there was P423.4 million in net foreign selling for the day.

Despite the PSEi’s slight gain, market breadth was negative.

There were 116 decliners that edged out 95 advancers while 53 stocks were unchanged.

The PSEi was led higher by PLDT and GT Capital, which both gained over 2 percent, while SM Investments and Globe Telecom both added over 1 percent.

Ayala Land, SM Prime, Jollibee and JG Summit also firmed up.

Some investors focused on trading opportunities outside the PSEi basket.

Now Corp., the day’s most actively traded stock and among those benefiting from a third telco play, surged by 29 percent and was the day’s most actively traded company.

Italpinas rallied by 8.98 percent while PXP Energy added 4.56 percent.

On the other hand, Metro Pacific fell by 3.3 percent while BDO slipped by 2.12 percent.

Metrobank went down by 1.4 percent while Ayala Corp., URC and BPI slightly dipped.