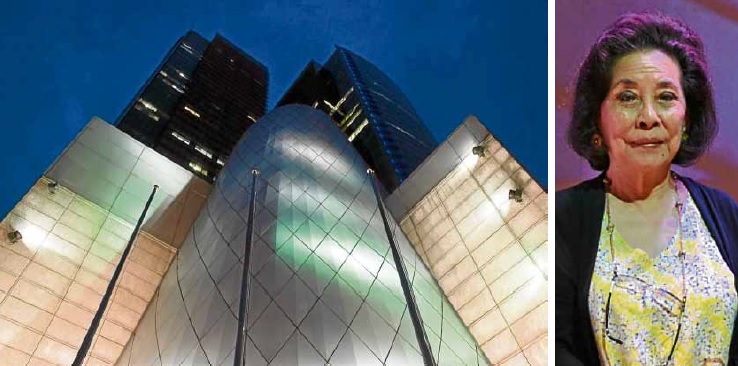

RCBC nets P4.3B

Yuchengco-led Rizal Commercial Banking Corp. grew its net profit last year by 11.4 percent to P4.3 billion, boosted by a strong performance in the fourth quarter.

For the fourth quarter alone, RCBC’s net profit surged by 146 percent year-on-year to P904 million, driven by a double-digit growth in both net interest income and other operating income.

“The bank is on track and ready to take advantage of the opportunities expected from the favorable business environment in 2018,” RCBC president Gil Buenaventura said in a disclosure to the Philippine Stock Exchange on Tuesday.

RCBC’s net interest income for the fourth quarter expanded by 27 percent year-on-year while non-interest income for the period also grew by 19 percent.

For the full-year, net interest income rose by 15 percent to P18 billion, as higher margins were accompanied by a double-digit growth in loan volume.

Net interest margin for the year improved by 19 basis points to 4.24 percent while the loan book expanded by 16 percent to P353 billion.

All loan market segments sustained growth last year but the fastest growing were the high-margin businesses. Small and medium enterprise (SME) loans grew by 39 percent while microfinance lending business through Rizal MicroBank also expanded by 39 percent.

Credit card lending grew by 29 percent while overall consumer lending rose by 15 percent. Corporate lending expanded by 12 percent.

Fee-based business, on the other hand, amounted to P3.4 billion, accounting for 14 percent of gross income, which in turn reached P25.1 billion.

Growth in operating expenses was contained at 2.3 percent to P17.8 billion, mostly spent for the opening of new branches and deployment of new automated teller machines (ATMs). RCBC opened 27 new branches to end the year with 508 in its network while 74 new ATMs were added to bring total to 1,562 machines.

“Our delivery channels are geared up with new branches and improved ATM systems supported by strengthened security systems in anticipation of the increased client activity in 2018. Competition, however, will continue to be strong. The RCBC management understands this all too well and is prepared to address this with a strong sense of urgency, as we pursue our business plans, key initiatives and key transactions this year,” Buenaventura said.

RCBC ended last year with a balance sheet of P556.3 billion. On the funding side, deposits rose by 10 percent to P35.3 billion while capital funds amounted to P67.1 billion.

Capital adequacy ratio (CAR) stood at 15.47 percent of risk assets while core or tier 1 capital stood at 12.46 percent of risk assets. Both are well above the minimum requirements of 10 percent and 6 percent, respectively.

On asset quality, bad loans represented 1.25 percent of total loans at yearend.