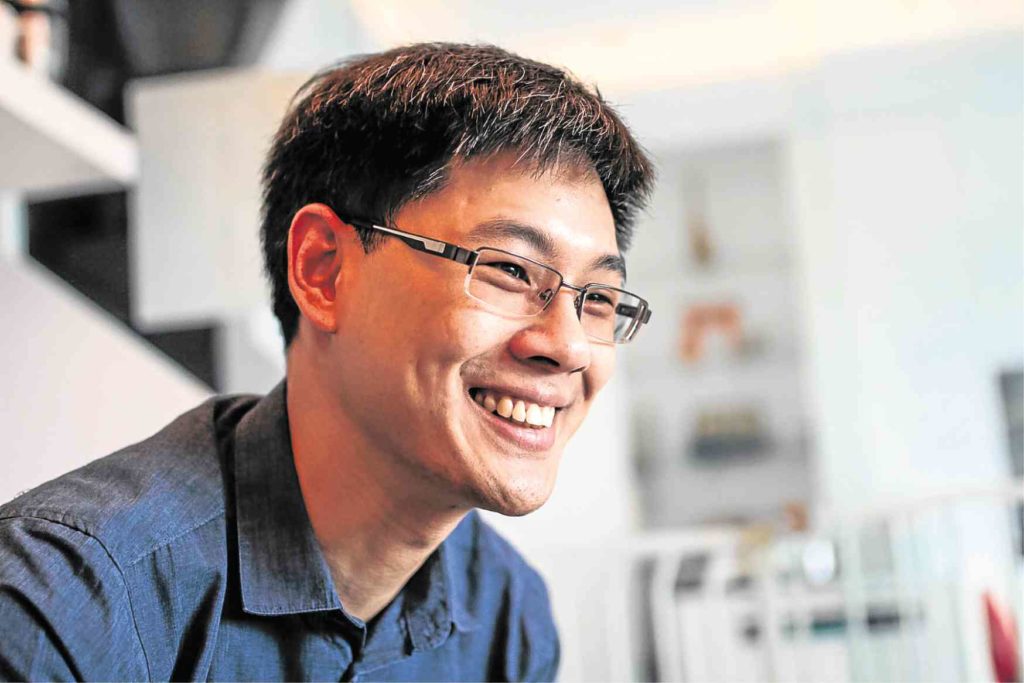

DOF undersecretary Karl Kendrick Chua

—Photos by LEO M. SABANGAN II

The Department of Finance on Monday blamed the over three-year high inflation of 4 percent in January on alleged profiteering by unscrupulous traders who took advantage of the higher excise tax rates slapped on a number of products under the Tax Reform for Acceleration and Inclusion (TRAIN) Act.

“The temporary inflation spike could also be attributed to the apparent profiteering by some traders, contrary to claims that this was caused by the implementation of the new tax reform law,” Finance Undersecretary Karl Kendrick T. Chua said in a statement.

“Certain retailers selling old stocks they procured before the Jan. 1 effectivity of the TRAIN seemingly took advantage of this new law and imposed excessive price adjustments, which led to last month’s higher-than-expected inflation rate,” Chua explained.

“Prices are expected to normalize once the markets adjust and the government intensifies its monitoring campaign to check any unwarranted price movements of basic goods,” according to Chua.

When the government announced the higher-than-expected January headline inflation rate last week, Finance Secretary Carlos G. Dominguez III suspected unscrupulous businessmen could have raised prices unreasonably.

“I have to look at the figures closely but I find it hard to believe that the implementation of the TRAIN Law, which went into effect on Jan. 1, 2018, had any significant effect on prices, unless, of course, merchants took advantage of the law and raised prices on old inventories,” Dominguez had said.

Signed by President Duterte in December, the TRAIN Law starting Jan. 1 this year jacked up or slapped new excise taxes on oil, cigarettes, sugary drinks and vehicles, among other goods, to compensate for the restructured personal income tax regime that raised the tax-exempt cap to an annual salary of P250,000.