Weak stock trading seen this week as fears linger

Local stocks are seen to continue trading with weak sentiment this week as concerns about a faster pace of US interest rate increases keep most investors risk-averse.

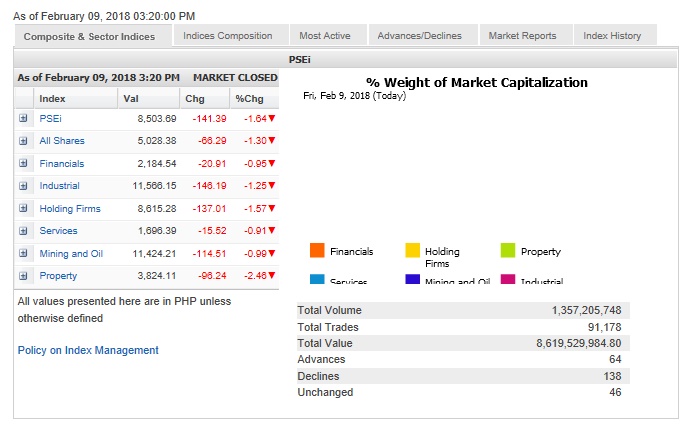

Last week, the Philippine Stock Exchange index (PSEi) lost a total of 307.06 points or 3.5 percent to close on Friday at 8,503.69, ending its worst week so far this year. Last week’s decline wiped out all gains made earlier this year.

BDO Unibank chief strategist Jonathan Ravelas said last week’s decline suggested that the market would range between 8,350 and 8,700 over the near term.

“But a break below 8,300 could risk a test of the 8,100 levels,” he said.

Christopher Mangun, head of research at Eagle Equities Inc., said the recent wave of foreign selling seemed to be easing as daily outflows had slowed down to just above P100 million from more than P2 billion.

Article continues after this advertisement“We are currently down by 2.9 percent for the month of February but I have no doubt that we will see a recovery before the end of the month,” Mangun said.

Article continues after this advertisement“I will not be surprised if we lose another 200 points (this) week. However, I am also confident that if we do, we will see it hold our major support at 8,300. If this scenario plays out, we will see the index bounce off that support line and break above 9,000. This is called a bear trap. This is beneficial for our market as more of the weak hands will be shaken out,” Mangun said.

A bear trap is a false signal that the rising trend of a stock or index has reversed when it has not, he noted.

Despite last week’s foreign selling, Mangun noted that above-average value turnover meant that local investors and institutions were waiting for buying opportunity.

Meanwhile, Mangun was surprised that the inflation-targeting Bangko Sentral ng Pilipinas (BSP) did not raise interest rates during its monetary setting on Thursday. The policy rate-setting was in the aftermath of a report that the January inflation rate had shot up to a three-year high of 4 percent, hitting the upper end of the BSP’s target range.

“We may see a rate increase in the following months,” Mangun said. —DORIS DUMLAO-ABADILLA