Cemex 2017 results as disclosed to the Philippine Stock Exchange

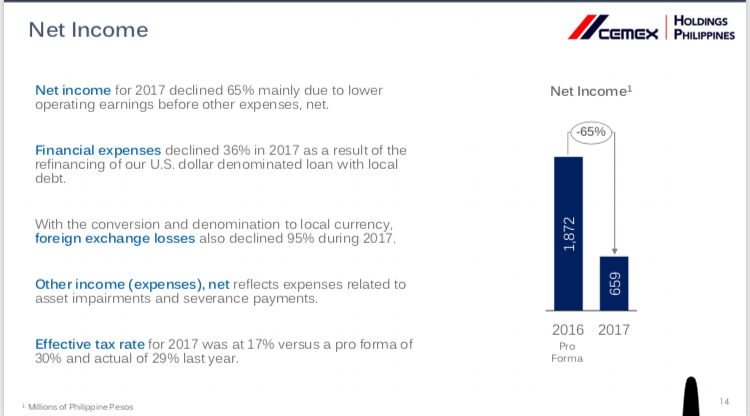

Cement-maker Cemex Holdings Philippines Inc. saw a 65-percent drop in net profit to P658.8 million last year as operating profit was weighed down by lower prices and higher fuel and distribution expenses while sales volume was flat amid stiff competition.

For the fourth quarter alone, Cemex incurred a net loss of P29.15 million, 306-percent higher than the net loss in the same period year-on-year, although domestic sales volume started to pick up during the period.

Cement volume increased by 10 percent in the fourth quarter despite the challenging weather conditions, bringing the full-year average growth to 1 percent.

“Public infrastructure spending continued to increase in the last three months of the year, driving demand for our products, and compensated for a slowdown in private construction activity,” Cemex disclosed to the Philippine Stock Exchange on Friday.

Cemex reported that net sales for the fourth quarter reached P5.2 billion, 1 percent lower year-over-year. Operating cash flow stood at P628 million compared to P1.4 billion in 2016 due to lower prices and higher fuel and distribution expenses.

But cost of sales increased year-over-year by 12 percentage points during the fourth quarter and by 8 percentage points for the whole of 2017. Higher fuel prices and

a lower base of revenue were the main drivers for this increase. As a percentage of cost of sales, power and fuels accounted for 21 percent and 22 percent, respectively, for the full year.

Ignacio Mijares, Cemex president, said Cemex “remains positive on the prospects of Philippine construction, with expectations of sustained economic expansion in 2018.”

“We remain focused on executing our capacity expansion plan in Solid Cement Plant. In addition, we are undertaking efforts to debottleneck our operations, achieve higher customer service levels, and reduce costs to drive growth for our business,” he said.

Full-year net sales reached P21.8 billion, down by 10 percent from the previous year, mainly attributed to lower cement prices.

Domestic cement prices decreased by 9 percent year-on-year during the fourth quarter and by 10 percent during the full year. On a sequential basis, Cemex’s fourth quarter prices declined by 1 percent while prices were flat for the last five months of the year.

Cemex is an indirect subsidiary of Mexico’s CEMEX S.A.B. de C.V., one of the largest cement companies in the world based on annual installed cement production capacity.