The local stock index slipped on Thursday as bond jitters returned to spook global markets ahead of a closely watched local monetary setting meeting.

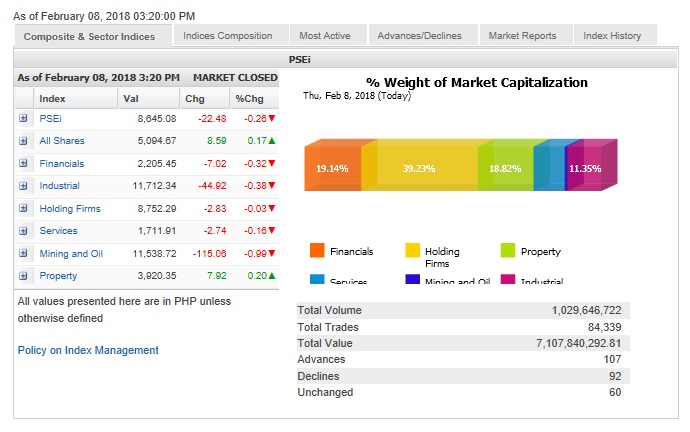

The main-share Philippine Stock Exchange index (PSEi) shed 22.48 points or 0.26 percent to close at 8,645.08, tracking the overnight slump on Wall Street.

After the day’s closing, the inflation-targeting Bangko Sentral ng Pilipinas announced that it had kept key interest rates unchanged despite the spike in the January inflation rate.

However, it raised inflation forecasts this year and next year to 4.3 percent and 3.5 percent, respectively, from 3.4 percent and 3.2 percent.

Looking forward, Papa Securities said the market might not be out of the woods yet as volatility remained high.

“With this, it might be best to raise cash and sell on strength closer to the index’ initial resistance of 8,700 given the possibility of sudden downturns in the US market,” Papa Securities said.

“Likewise, we recommend buying near the trend channel support at 8,380,” it added.

The PSEi was weighed down by the financial, industrial, holding firm, services and mining/oil counters.

On the other hand, the property counter slightly firmed up.

Value turnover for the day amounted to P7.11 billion.

Despite the PSEi’s decline, market breadth was positive as investors scouted for buying opportunities outside the main basket.

There were 107 advancers that edged out 92 decliners while 60 stocks were un changed.

The PSEi was weighed down most by URC, which fell by 2.29 percent, while SM Investments, PLDT, Merobank and Semirara all lost over 1 percent.

Jollibee, AGI, Security Bank and BPI also slipped.

One notable decliner outside of PSEi stocks was Megawide, which fell by 3.5 percent after a rival bidder for the Naia rehabilitation announced a unit of Changi of Singapore as the consortium’s technical partner.

Meanwhile, Ayala Corp., BDO, SM Prime and Megaworld slightly firmed up.