The local stock barometer pulled back on Tuesday but managed to pare intraday losses to stabilize at the 8,500 level against a grim backdrop of a global equities selldown and a spike in the local inflation rate.

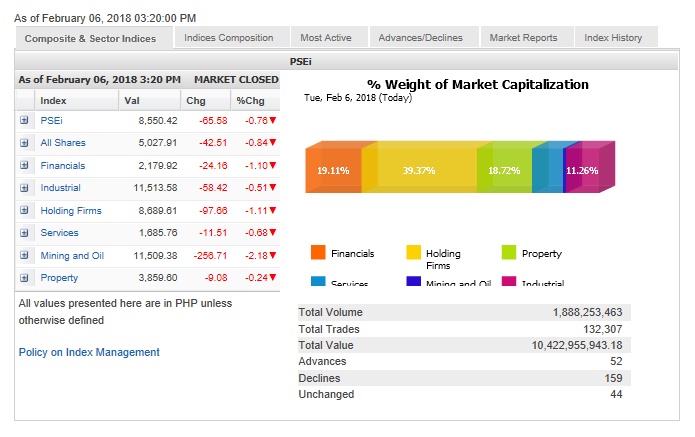

The Philippine Stock Exchange index (PSEi) lost 65.58 points or 0.76 percent to close at 8,550.42, sliding for the second trading session.

The index slid to as low as 8,379.83 in intraday trade as the market’s pullback in recent days attracted a wave of bargain-hunting.

The PSEi peaked at 9,078.37 in intraday trade on Jan. 29 but had pulled back sharply in line with a global correction since then.

On Monday, the closely watched Dow Jones Industrial Average (DJIA) slumped by 4.6 percent to close at 24,345.75, erasing its 2018 year-to-date gains.

“The selloff continued after last Friday’s strong jobs data prompted higher expectations for inflation, and therefore higher rates for bonds. Investors continued to move money from stocks into bonds, prompting the decrease for the DJIA,” Papa Securities said in a research note.

Looking forward, Papa Securities sees buying opportunities between 8,400 and 8,500.

“It is also possible that we could already see the index form its low this week before bouncing back in anticipation of a possible Chinese New Year rally,” the brokerage said.

Papa Securities sets the next support at 8,323 and the next resistance levels at 8,838 and 9,078.

All counters declined on Tuesday but the worst hit was the mining/oil counter, which lost 2.18 percent. The financial and holding firm counters both shed more than 1 percent.

On Tuesday, it was also reported that Philippine inflation rate had unexpectedly shot up to 4 percent, overshooting the 3.5-percent market consensus.

Total stock trades amounted to P10.42 billion. There were 159 decliners that overwhelmed 52 advancers while 44 stocks were unchanged.

The PSEi was weighed down most by AEV, which fell by 4.07 percent, while BPI declined by 3.12 percent.