The local stock barometer slumped for the third straight session yesterday as rich valuations continued to attract profit-taking.

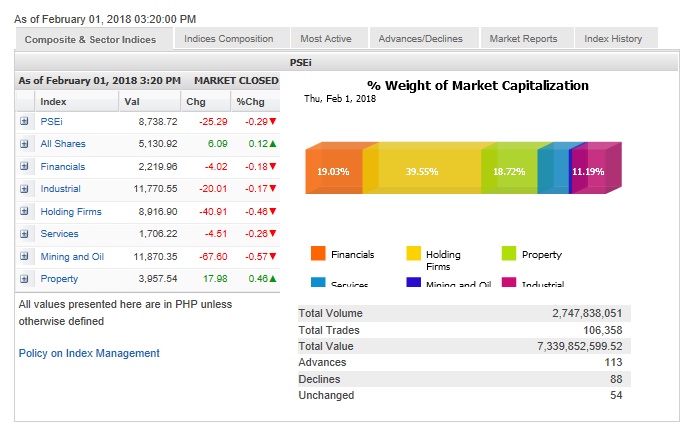

Reversing the rebound seen in early trade, the Philippine Stock Exchange index (PSEi) ended 25.29 points or 0.29 percent lower at 8,738.72.

The PSEi has been falling since hitting an all-time high of 9,078.37 on Monday.

Elsewhere in the region, most stock markets firmed up as earlier concerns over rising bond yields had been offset by a benign outlook for growth and corporate earnings.

At the local market, the PSEi was weighed down by the financial, industrial, holding firm, services and mining/oil counters. Only the property counter eked out a modest gain.

Value turnover for the day stood at P7.34 billion. There were 113 advancers that edged out 88 decliners while 54 stocks were unchanged.

“The index’s RSI (relative strength index) is still a few points away from the oversold level so sellers may not be exhausted yet,” Papa Securities said in a research note.

Papa Securities pegged the next support level at 8,720, followed by 8,640.

“On the bright side, it doesn’t seem like the foreign selling we’re experiencing is isolated to the Philippines as others in the region like Indonesia and Thailand experienced net outflows in the past two days as well,” it said.

ICTSI fell by over 2 percent while SM Prime, Ayala Corp., Semirara and Meralco all tumbled by over 1 percent.

SM Investments, BDO, URC, Metrobank, JG Summit and AGI all slipped.

Notable decliners outside the PSEi included TBGI, which lost 8.06 percent after previously surging on the back of third telco speculations.

Ayala Land bucked the day’s downturn with its 2.49-percent gain. Jollibee also rose by 0.84 percent.

Investors scouted for buying opportunities outside the PSEi. National Reinsurance rallied by 19.69 percent while MacroAsia surged by 10.33 percent in heavy volume.

Other notable gainers were Now Corp. and IMI, which both added over 3 percent.