PSEi declines by 1.64% on profit-taking

The local stock barometer saw a second day of bloodbath yesterday as weak investor sentiment arising from a global bond sell-off induced more profit-taking.

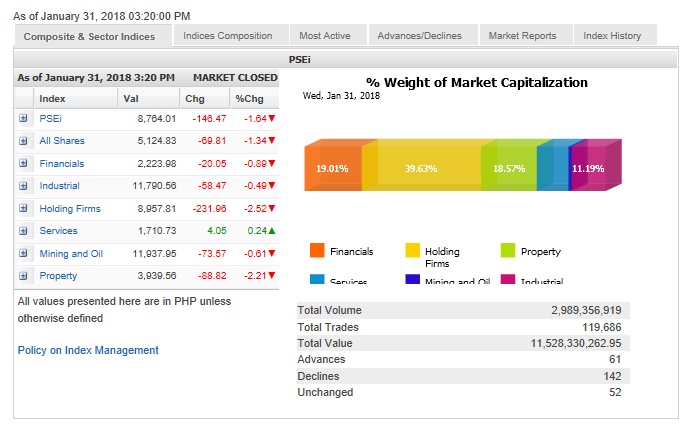

The Philippine Stock Exchange index (PSEi) slid by 146.47 points or 1.64 percent to close at 8,764.01, tracking the overnight slump in Wall Street.

A break below 8,800 is something to watch out for as it could trigger a much larger correction toward the 8,000 levels, BDO Unibank chief strategist Jonathan Ravelas said.

“It looks like the index’ decline was led by funds taking profits after the PSEi had reached high levels above 9,000,” Papa Securities said in a research note.

“Looking forward, it might pay off to take profits in the meantime as there could be some interim rallies.”

Papa Securities sees the next strong support level at 8,730.

Article continues after this advertisementThe PSEi was weighed down most by the holding firm and property firms counters, which both tumbled by over 2 percent while the financial, industrial and mining/oil counters also slipped. Only the services counter firmed up albeit by a very modest pace.

Article continues after this advertisementValue turnover for the day stood at P11.53 billion.

There were 142 decliners that overwhelmed 61 advancers while 52 stocks were unchanged.

SM Investments Corp., the most actively traded company, dragged the PSEi with its 5.96-percent decline.

Ayala Land fell by 2.96 percent while SM Prime and LTG likewise both slipped by over 2 percent.

BDO, URC and JG Summit all lost over 1 percent while BPI, GT Capital, Metrobank, Security Bank, Metro Pacific and PLDT all slipped.

Outside the PSEi, Now Corp.—a market favorite in recent days as people speculated on which could be the third telecom player—pulled back by 10.30 percent.

On the other hand, DMCI and Jollibee bucked the day’s downturn, both firming up slightly.

Investors also loaded up on shares of companies outside the PSEi. ATN Holdings surged by 35.63 percent in relatively heavy volume while TBGI racked up 3.33 percent. Stock pundits said ATN, which has the same controlling shareholders as TBGI, rode on the same telco play that benefited TBGI.

Vista Land added 1.3 percent.