The local stock barometer pulled back from record highs on Wednesday as investors pocketed gains as soon as the main index neared a tough barrier at 9,000.

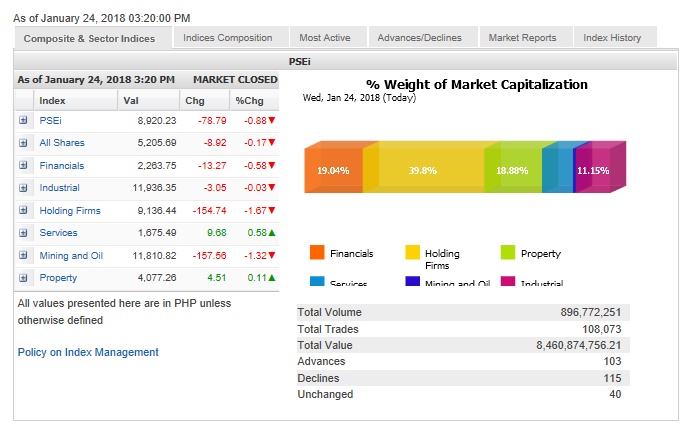

The Philippine Stock Exchange index (PSEi) gave up 78.79 points or 0.88 percent to close at 8,920.23, tracking the regional correction.

Dealers said 9,000 was still a tough resistance to break especially after the lower-than-expected fourth quarter economic growth.

The PSEi was weighed down most by the holding firm and mining/oil counters. The financial and industrial counters also slipped.

On the other hand, the services and property counters eked out modest gains.

Total value turnover for the day amounted to P8.46 billion. There were 115 decliners that edged out 103 advancers while 40 stocks were unchanged.

LT Group weighed down the PSEi with its 4.26-percent decline following news that the next wave of tax reforms would affect tobacco and alcohol.

BPI and GT Capital both slipped by 2.4 percent.

Investors also pocketed gains from BDO and SM Prime. SM Investments, Ayala Corp., Jollibee and Globe Telecom also slipped.

On the other hand, Ayala Land and Metrobank bucked the day’s downturn, both gaining over 1 percent. URC, PLDT and Security Bank also gained.

Many of the actively traded stocks are non-PSEi companies, suggesting investors were scouting for alternative plays.

For instance, Villar-led Golden Haven—a memorial park developer that plans to diversify into mass housing—surged by 39.49 percent while NOW Corp. racked up 14.69 percent on a third-telco player speculation.

Gaming firms Melco and Bloomberry also advanced by 10.48 percent and 5.33 percent.

“I’m surprised how strong gaming companies are doing despite the news that package 2 of [tax reforms] will include taxes on casinos, aside from additional taxes on tobacco, alcohol, mining and coal,” COL Financial head of research April Lee-Tan said.