The local stock barometer surged to a new high on Tuesday—closing a hairline away from the 9,000 mark—as investors scooped up equities that fell following the report of slower-than-expected fourth quarter Philippine economic growth.

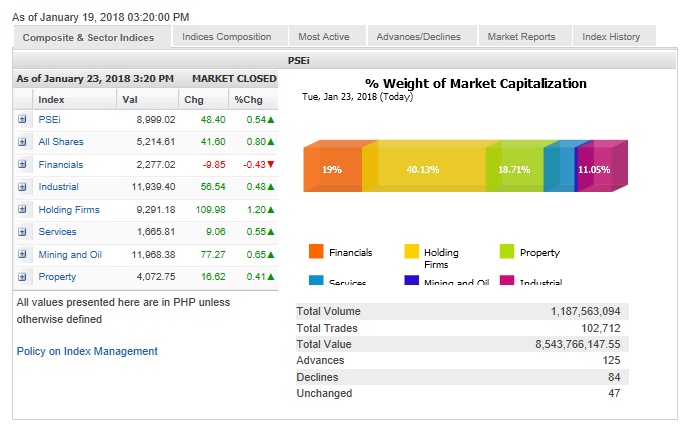

The main-share Philippine Stock Exchange index (PSEi) added 48.4 points, or 0.54 percent, to close at 8,999.02, likewise drawing strength from upbeat regional markets.

The PSEi advanced for the third straight session and marked its fifth record finish this 2018. Since the start of the new year, the index has gained another 5.1 percent, after rising by 25 percent for the whole of 2017.

“The market faltered initially (in morning trade) because of the GDP (gross domestic product) growth number,” said Eagle Equities Inc. president Joseph Roxas.

Philippine GDP grew by 6.6 percent year-on-year in the fourth quarter, slightly lower than the market consensus of 6.7 percent. In morning trade, the PSEi shed 31.95 points, or 0.36 percent.

“When they thought that it’s just a small difference, investors resumed buying (in the afternoon). There’s really a lot of money and investors are just waiting to buy on correction,” Roxas said.

However, Roxas said 9,000 still appeared to be a strong resistance level. On the downside, the next support level is seen at 8,700.

Jonathan Ravelas, Banco De Oro Unibank Inc. chief strategist, said the share price drop would only “open a window for investors who missed the rally.”

But any market weakness, Ravelas said, would only be short-lived as the fourth quarter corporate earnings season would start by February.

The market was led higher by the holding firm counter, which gained 1.2 percent. All other counters advanced, except for the the financial counter.

Value turnover for the day stood at P8.54 billion. Foreign investors supported the day’s upswing as there was P264.82 million in net foreign buying.

There were 125 advancers that edged out 84 decliners while 47 stocks were unchanged.