PH loses luster among foreign property investors

ULI-PwC real estate emerging trends 2018: ranking of key markets

Metro Manila, erstwhile one of Asia-Pacific’s “hottest” markets for international property investors and developers, has lost some luster this 2018 due to concerns on rising US interest rates, domestic political jitters and limited opportunities for foreigners to find deals.

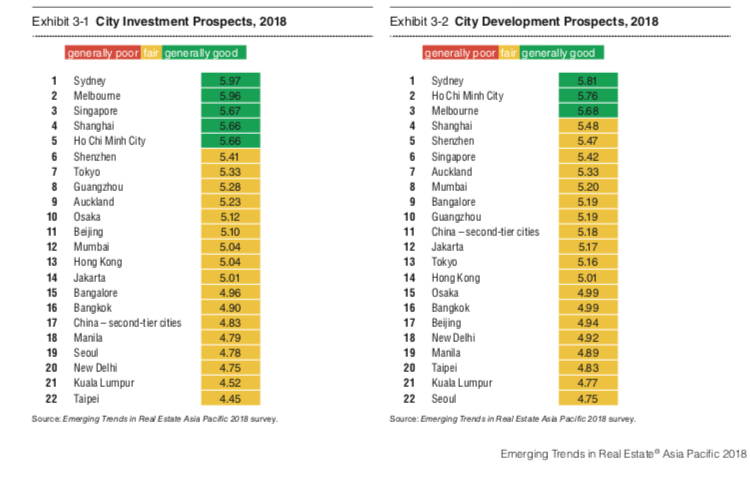

Based on the 2018 Emerging Trends in Real Estate® Asia Pacific 2018 drawn up by Urban Land Institute (ULI) and global advisory firm PwC, Metro Manila’s ranking in terms of investment prospects in real estate among 22 key markets in the region slid to 18th place from third last year.

For global institutions looking for development opportunities, Metro Manila’s ranking also declined to 19th place from fourth last year.

The five cities that topped this year’s ULI-PwC ranking in terms of city investment prospects were Sydney, Melbourne, Singapore, Shanghai and Ho Chi Minh. For city development prospects—typically more relevant among core developers rather than opportunistic investors—the top five cities are Sydney, Ho Chi Minh, Shanghai and Shenzen.

The report said that the Philippines remained a “healthy” market, with both rents and capital values continuing to trend upward amid an infrastructure boom and economic growth of some 6.5 percent. “However, concerns over US base rate increases, together with domestic political issues have been a drag on sentiment among foreign investors, as have longstanding difficulties in finding good local partners with whom to work [with],” the report said.

The latest ULI report was presented last week by Arel Shtarkman, ULI senior content adviser and founder of Orca Capital, who said that the Philippines and Indonesia were out of flavor among investors migrating to developing markets.

“Local partners and developers in the Philippines don’t really need foreign investor money. The cost of money for a private equity fund to come here in lieu of a local property developer is too high. You (local developers) can go to a bank and get good financing money. So if you look at the investor base, they just can’t find the right deals,” Shrakman said in a forum attended mostly by property developers and professionals.

The written report elaborated on the impact of political uncertainties. “Sentiment among overseas investors has recently been dented by political controversies, an on/off territorial rights dispute in the South China Sea, and ongoing fighting with insurgents in the south of the country.”

On the other hand, she noted that interest had surged on Vietnam, which many believe could be the next China.

The ULI report noted how investors continued to draw favorable comparisons between Vietnam and China of 10 to 15 years ago.

“Vietnam’s GDP growth is in the area of 7.4 percent, and while bureaucracy remains an issue, the regulatory environment is becoming slowly less restrictive. Notably, our survey ranked Ho Chi Minh City among the highest in terms of rental value growth, reflecting confidence that economic strength will spill over to property values. Unsurprisingly, Vietnam remains very much a development story, although the number and size of opportunities tend to be relatively small,” the report said.

In the case of the Philippines, the ULI-PwC report noted that office demand had been driven by the phenomenally successful business process outsourcing (BPO) sector. Although growth in this area has slowed, it deemed that office fundamentals continued to be “very strong,” with vacancies standing at a low 3 percent, while rent and capital values in the first half of 2017 rising at a healthy 5.3 percent and 8.6 percent respectively, year-on-year, based on JLL data.

To the extent that BPO growth has slowed, the slack has been taken up by new demand from offshore online gaming companies, which are now the second-largest occupier of office space in Metro Manila after the BPO sector. Yet, some investors still question whether this would be a sustainable trend.

Meanwhile, the report noted that Australia was able to satisfy the requirements of investors and developers, noting that “its gateway cities combine the appeal of a stable investment environment with a combination of relatively good current yields and the prospect of strong rental growth going forward,” explaining the strong performance by both Sydney and Melbourne in this year’s rankings.

Across the region, the research noted that stiff competition for assets was changing the industry in fundamental and often unexpected ways. For instance, it cited investor migration into markets and asset classes that in the past did not receive much interest, such as data centers, affordable housing projects, build-to-rent (or co-living) facilities as well as student and senior housing.

Another trend quickly gaining traction across Asia is the boom in shared workplaces, with co-working operators now the biggest demand driver for new office space in many cities across the region.