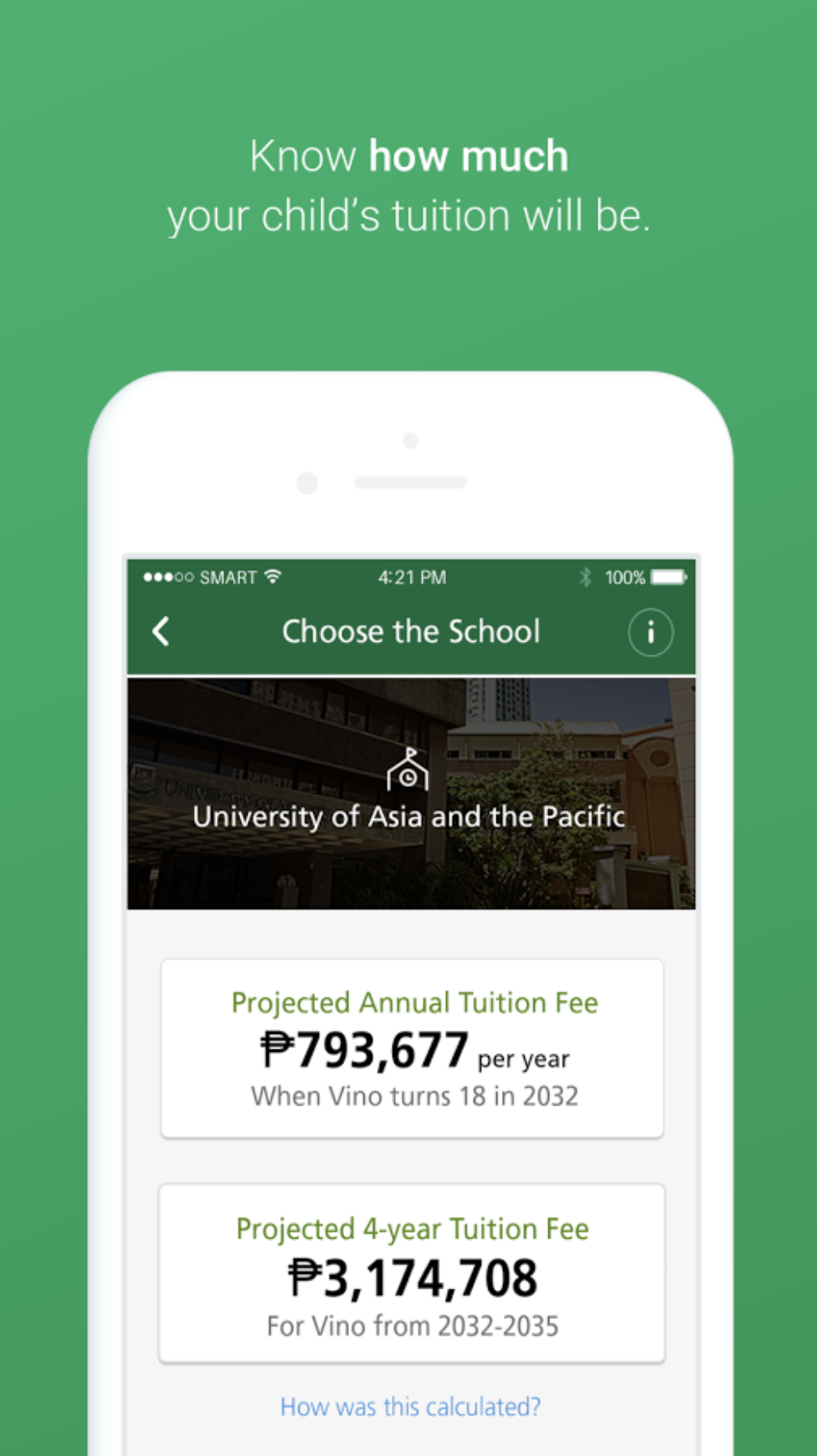

Manulife’s GradMaker app

Insurance and wealth management house Manulife Philippines has rolled out a pioneering mobile application designed to help young parents start building funds for their children’s college education for as low as P10,000 in investment.

Designed for start-up parents who are too busy to meet with investment counselors or financial advisers or those who think investing is expensive, “GradMaker” invests in professionally managed funds composed of stocks and bonds and provides life insurance coverage of at least 125 percent of the customer’s single premium.

“Education is one of the most significant investments many families will make, and, on average, tuition fees increase by 10 percent yearly, according to the Bangko Sentral ng Pilipinas,” Manulife Philippines president and CEO Ryan Charland said in a statement.

“Through GradMaker, we aim to help parents be prepared by providing visibility on how much and how long they need to invest for their child’s college education,” he said.

The investing app targets long-term growth of capital and requires no lock-up period.

“Being relevant comes from a deep understanding of our customers and allowing them to decide when and on which platform to engage with us,” Charland said.

“GradMaker is intuitive, simple, and designed from the customer’s perspective,” he added.

The app allows parents to learn about projected education costs at their preferred local university by the time their child goes to college. It also helps calculate how long and how much they need to save to get there. When they are ready to invest, they can purchase a GradMaker plan using the same app.