The local stock barometer pulled back sharply yesterday as rising bond yields curbed risk-taking across regional markets.

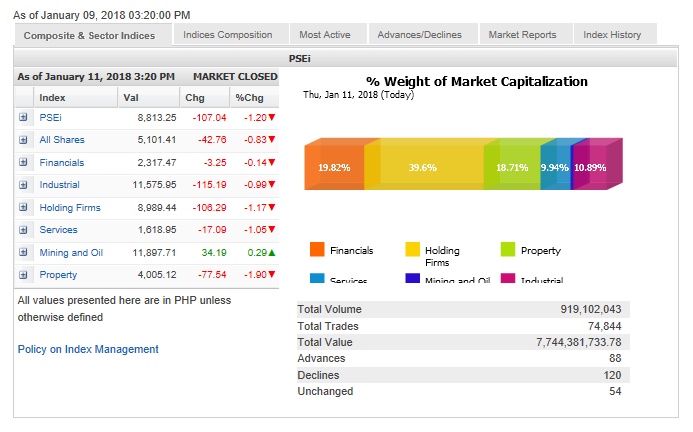

The main-share Philippine Stock Exchange index shed 107.04 points or 1.2 percent to close at 8,813.25, declining for the second straight session after breaching successive record highs.

The PSEi hit an all-time high finish of 8,923.72 on Jan. 9 and a record intraday peak of 8,926.78 on Jan. 10.

Except for the mining/oil counter which was modestly higher, all counters declined yesterday, led by the holding firms, services and property counters which all lost over 1 percent.

Value turnover for the day amounted to P7.74 billion. There were 120 decliners that outnumbered 88 advancers, while 54 stocks were unchanged.

After several days of heavy buying, foreign investors were net sellers this time amounting to P878.96 million.

Rising bond yields tend to lure investors into fixed income investments and temper appetite on equities. The recent run-up to dizzying heights also invited some profit-taking.

Elsewhere in the region, stock markets also slipped from record highs.

The PSEi was weighed down by Metro Pacific and PLDT, which both fell by over 3 percent.

Ayala Land, SM Investments, URC, DMCI and JG Summit all declined by over 2 percent.

BPI, SM Prime, Megaworld and ICTSI all slipped by over 1 percent. Ayala Corp., Jollibee and Puregold also declined.

On the other hand, GT Capital surged by 4.92 percent while San Miguel Corp. added 3.13 percent.

RRHI rose by 1.86 percent while BDO, Metrobank and Security Bank also gained.