DOE deploys teams to monitor filling station, fuel depots

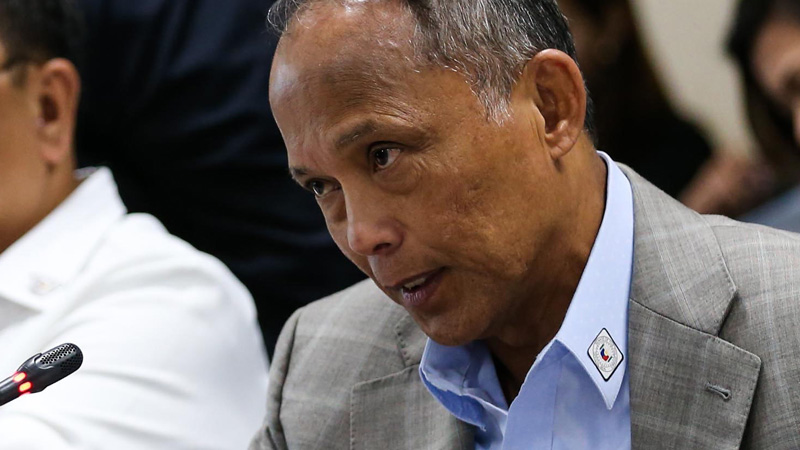

Energy Secretary Alfonso Cusi (File photo by LYN RILLON / Philippine Daily Inquirer)

The Department of Energy is deploying a team of inspectors to monitor filling stations and fuel depots as new taxes took effect last Jan. 1.

The inspectors will randomly inspect the inventory of gasoline stations and depots for proper oil excise tax implementation, amid consumer fears that companies might pass on to them the new taxes even with old stocks that were not subject to these.

“Violators may be administratively subjected to the cancellation of their certificates of compliance (COC),” Energy Secretary Alfonso Cusi said in a statement issued on Wednesday.

Cusi said criminal cases such as estafa and profiteering may be filed in court for violations of the oil industry deregulation law as well as of the Revised Penal Code.

“The DOE will also endorse these violators to the Bureau of Internal Revenue for a special audit,” he said.

Energy officials earlier said they expected the new taxes under the Tax Reform for Acceleration and Inclusion (Train) program to be not reflected on pump prices until the middle of January, considering that oil firms were required to maintain a minimum stock good for 15 days.

Under the first year of the Train program, taxes on gasoline will rise by P2.97 per liter including VAT. Before the Train, gasoline is levied at a total of P4.87 per liter.

Also, diesel will now be taxed at P2.80 per liter including VAT while kerosene will be levied at P3.36 per liter.

Liquefied petroleum gas (LPG) for cooking will now bear a levy of P1.12 per kg while LPG for vehicles will now be taxed at P2.80 per kg.

By 2020, taxes on gasoline will be at P11.20 per liter; diesel at P6.72 per liter; kerosene at P5.60 per liter.

Taxes on LPG for cooking will be at P3.36 per kg and that on auto LPG at P6.72 per kg. /atm