PSEi closes above 8,900 mainly on foreign buying

The local stock barometer yesterday surged past the 8,900 level for the first time as foreign investors loaded up more equities amid rosy prospects for the economy.

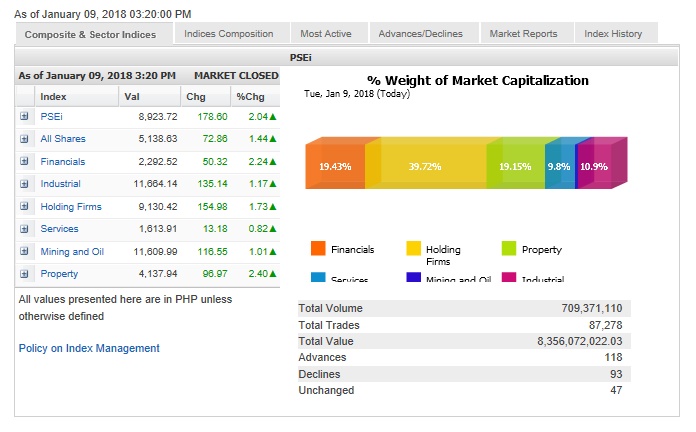

The main-share Philippine Stock Exchange index rallied by 178.6 points or 2.04 percent to close at a record-high 8,923.72, which also marked the intraday peak.

The market was buoyed by about P1.42 billion in net foreign buying. Daily net foreign inflows to the market have exceeded P1 billion for the second straight session.

Stockbroker Joseph Roxas, president of Eagle Equities Inc., said investors were “repositioning for the year.” He expects the PSEi to continue its trek to new highs and hit 9,500 to 10,000 this year.

“Most investors were trying to outrace each other given a more positive outlook this year. It seems like some have yet to position themselves for 2018 which resulted in more demand in blue chips,” said Astro del Castillo, managing director at local fund management firm First Grade Finance.

“Reports of a more bullish outlook from fund managers and analysts contributed to the surge in the market. Many are still betting that fundamentals will be better and much stronger given the recent passage of tax reform and the momentum of the infrastructure program of government,” he added.

But given the low value turnover of about P8.36 billion, Del Castillo said the day’s bounce might soon be followed by profit-taking.

There were 118 advancers and 93 decliners, while 47 stocks were unchanged.

All counters surged, led by the financial and property counters which both rose by more than 2 percent. The holding firm counter also added 1.73 percent. These are the sectors that best track economic cycles.

The industrial and mining/oil counters both added more than 1 percent while services rose by 0.82 percent.

Retailer Puregold led the PSEi higher with its 7.15-percent gain, riding on bright prospects for consumption this year.

URC and BDO both surged by more than 5 percent while SM Prime and JG Summit added over 3 percent each.

Investors also picked shares of Ayala Land and SM Investments, which both rose by more than 2 percent, while Security Bank, GT Capital and BPI all gained more than 1 percent.