Its key component is the lowering of the personal income tax (PIT), which should benefit 99 percent of Filipino families, according to the Department of Finance (DOF).

While minimum wage earners and the unemployed may not benefit from the lowering of PIT, DOF said the targeted transfer program was designed to provide immediate benefits to poor families to help cushion the impact of the tax program on prices.

These benefits include the 10 percent discount on NFA rice —up to 20 kilos a month—and free skills training under Tesda.

“Prosperity for the poor, however, will not be achieved through subsidies, exemptions, and freebies but from better health services, improved roads, faster and safer modes of transportation, improved access to quality education, among other social services that will make them more productive and improve their opportunities to get better jobs and accelerate their graduation out of poverty,” said Finance Undersecretary Karl Kendrick Chua.

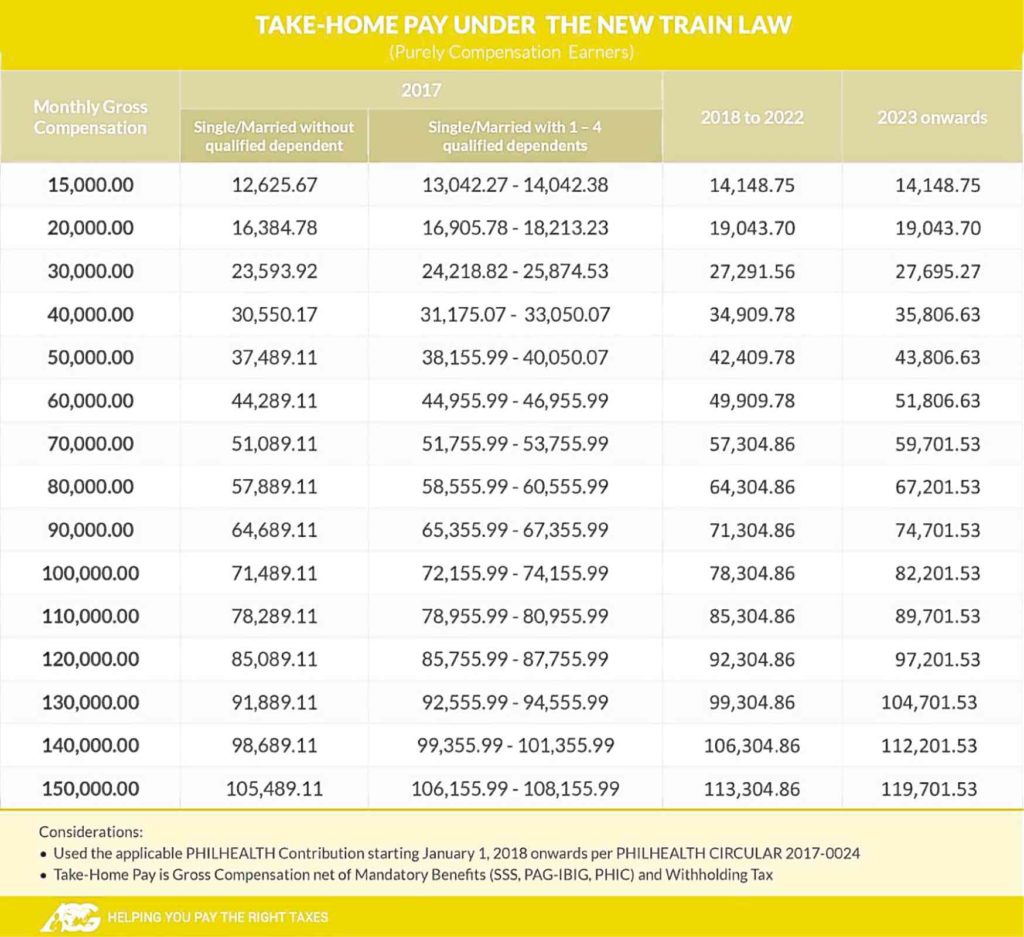

Provided here is the guide to employees’ higher take home pay effective Jan. 1, 2018.

Note, however, that the take home pay is reduced by the mandatory benefits i.e., SSS, Pag-ibig and Philhealth.

Further, personal and additional exemptions are no longer available since the income tax exemption was increased to P250,000 annually.

Overall, those earning a maximum of P21,000 a month are the real winners as they will now be exempted from paying income tax.

In this regard, Internal Revenue Commissioner Caesar Dulay issued RMC 105-2017, providing a revised Withholding Tax Table pursuant to RA 10963 to be used by every employer making compensation payments beginning Jan. 1, 2018:

For businesses with annual gross receipts/sales amounting to P3 million and below may now choose to pay the optional 8 percent flat rate in lieu of income and business taxes.

This option is also available to professionals with annual gross receipts/sales of P3 million and below.

More importantly, individual and corporate taxpayers must be mindful of the new regulations to be issued pursuant to our new tax laws like RMC 105-2017 to avoid unnecessary penalties and compromises.

Tax accountants and consultants must keep themselves abreast of all the changes in our tax laws and regulations, making sure their company and/or clients are guided accordingly as to the impact of these reforms on their business/es and industry at large.

In our social enterprise, we consider citizen tax planning as a game-changing strategy to help taxpayers pay the right taxes without the burden of unnecessary penalties and compromises.

For inquiries, visit www.acg.ph.

In partnership with the Bureau of Internal Revenue (BIR), our nonprofit organization, Center for Strategic Reforms of the Philippines, proposed a program to recognize and incentivize honest tax payments to uphold integrity and honesty in paying taxes.

Per RMC 60-2017, taxpayers are given the option to subscribe to the Seal of Honesty (SOH) Certification Program to help them improve their voluntary compliance as partners in nation building upon full satisfaction of the qualification criteria as a basis for entitlement of the benefits.

These include the issuance of the annual tax clearance, last priority audit and other privileges which the DTI and other government agencies may extend to certified SOH taxpayers. —CONTRIBUTED

For more information on the Seal of Honesty (SOH) Certification Program, e-mail us at info@sealofhonesty.ph or call 6227720.