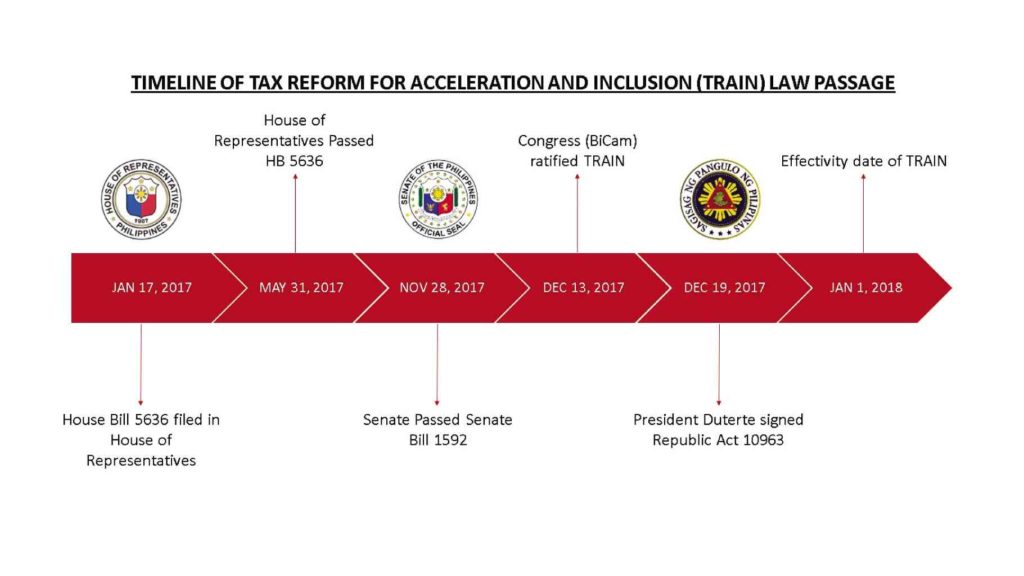

The passing of the Train

By this time, most Filipinos may already be anticipating a higher paycheck starting this month, following the passage of the Tax Reform for Acceleration and Inclusion Act (Train) into law last month.

That’s because one of the provisions of Train or Republic Act No. 10963 is to lower and restructure personal income tax rates which, until recently, had remained unchanged over the last two decades.

However, this same comprehensive tax reform package will also slap additional consumption taxes on oil, cigarettes, sugary drinks and vehicles—a move that will eventually raise prices of some goods and services. This has thus left some quarters apprehensive of the ultimate impact of this law once its implementation goes on full swing.

Positive change

Others meanwhile remained optimistic that the Train, whose approval was described by the government as an important milestone in the country’s history, will usher in “real positive change beginning in 2018.”

According to the Department of Finance, the Train would be giving back “almost P150 billion” to the people in the form of tax relief, while raising “significant revenues” to fund the President’s priority and social infra programs to reduce poverty from 21.6 percent to a targeted 14 percent by 2022.”

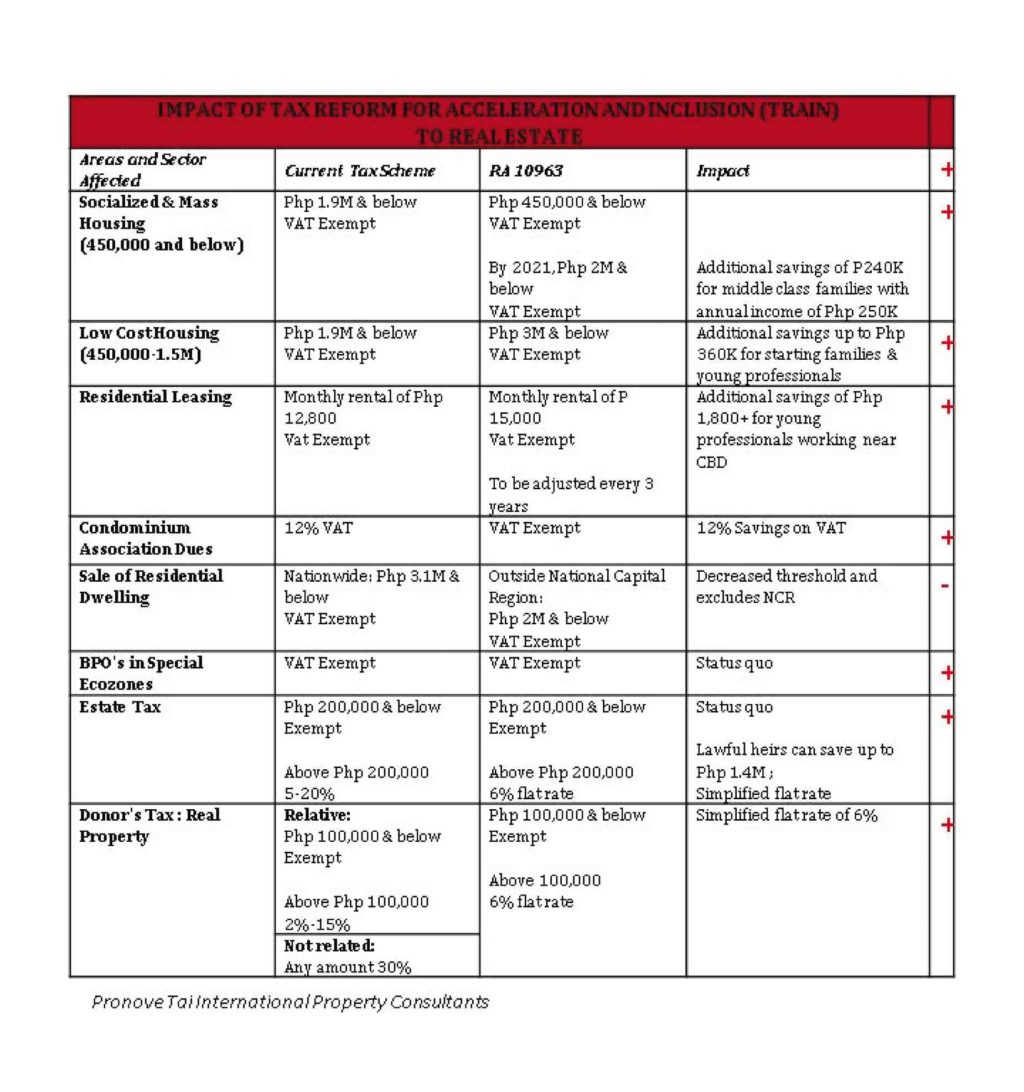

Pronove Tai International Property Consultants shared this same optimistic view, noting that while corporate and commercial property taxes were not included in the first package, several provisions would encourage growth across industries including real estate.

For instance, of the expected P130 billion revenue from Train, 70 percent will be allocated to infrastructure spending. Infrastructure development and decongestion of Metro Manila had always been two of the cornerstones of President Duterte’s economic agenda, said Monique Pronove, CEO of Pronove Tai.

“In general, better infrastructure means more efficient business. If projects to improve our public transportation, bridges and airports will be funded, investors will be encouraged to invest more in the country,” Pronove explained.

The retention of tax exemption for the IT-business process management firms (IT-BPM) in Philippine Economic Zone Authority accredited buildings and zones is also seen to sustain the growth of an industry that is currently one of the biggest drivers for the office property market.

Socialized housing

Pronove further noted that once the Train is implemented, “socialized housing transactions worth P450,000 and below as well as low cost housing worth P3 million and below will be exempted from value added tax (VAT). This is an improvement from the previously exempted low cost housing sales worth P1.9 million.”

“This translates to savings of up to P360,000 for starting families due to the VAT exemption,” Pronove explained.

Outside the National Capital Region, sale of residential dwellings worth P2 million and below will also be exempted from the 12 percent VAT.

“This provision supports the move to decongest Metro Manila,” she added.

And this should bode well too in the government’s efforts to address the rising mass housing backlog in the country, estimated to have reached some 5.7 million units, and in the private sector’s move to provide the market with affordable, decent housing.

Companies like leading mass housing developer 8990 Holdings Inc., for one, was reportedly eyeing to launch about P60 billion worth of new projects this year as it remains committed to its mission of providing affordable, decent homes to ordinary Filipinos.

8990 Holdings was also reportedly looking to offer this year some P10 billion worth of securities backed by housing receivables—said to be the first private sector-led housing securitization deal in the country. This move is likewise further seen to help open up a new horizon for housing finance, the company had said.

Other provisions

According to Pronove, young members of the workforce, who are likely to rent condominiums or apartments near their workplaces, “will benefit the most in the VAT exemption for lease of residential units being raised from P12,800 to P15,000 as well as the removal of VAT on association dues for condominiums.”

Both the estate tax and donor’s tax were likewise simplified to a flat rate of 6 percent based on the assessed value of the estate property. Estate tax is levied on the transfer of estate from the deceased person to their lawful heirs.

Under the previous system, transfer of estates with a value of P200,000 to P10 million above was levied taxes between 5 and 20 percent, Pronove said.

Additionally, with this new law, surviving heirs are allowed to withdraw any amount on the deceased person’s account to cover the expenses related to the estate transfer. Train removed the previous ceiling of P20,000 withdrawals and imposition of 6 percent withholding tax for all the withdrawals, Pronove explained.

On the other hand, donor’s tax is levied on transfer of the estate properties by gift or donation. The Train retains exemptions on estates worth P100,000 and below and imposed a flat rate of 6 percent on those estates with value of P100,000 and above whether the recipient is related or not, she further disclosed.

“Train simplified the tax policy by removing the 2 to 15 percent tax table as previously used,” she added.

“Twenty years is a long time. The tax code was definitely in need of a simplification to encourage compliance and increase generation. We remain hopeful that implementation will be done smoothly and efficiently,” Pronove concluded.