The local stock barometer slipped yesterday as investors pocketed gains realized at the opening of the week.

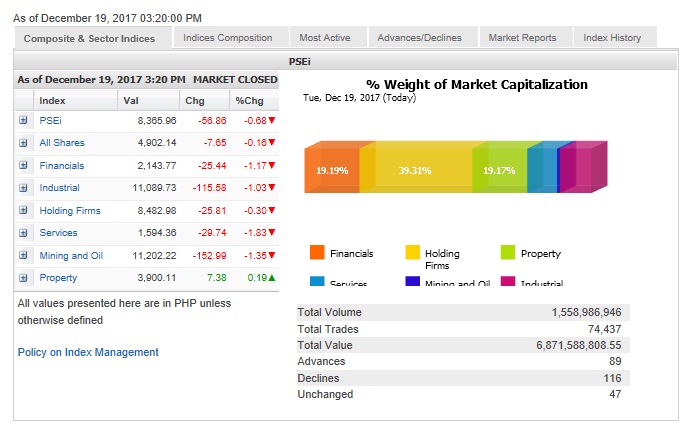

The main-share Philippine Stock Exchange index lost 56.86 points or 0.68 percent to close at 8,365.96.

“Philippine (stocks) succumbed to profit-taking as the 8,400 support could not be sustained. All this happened while US stocks closed higher Monday, as all indices breached records on growing confidence on the congressional-backed tax-cut legislation, expected to be passed as early as this week,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

“Locally, investors were anxiously awaiting developments brought about by the ratification of the TRAIN or the Tax Reform for Acceleration and Inclusion, which is the Duterte administration’s tax reform package. President Duterte signed this officially by the end of trading so the full reaction may be felt in the next trading period,” he said.

Except for the property counter, which was slightly up, all other counters ended in the red. The biggest decliners were the financial, industrial, services and mining/oil counters which lost more than 1 percent.

Value turnover was thin at P6.87 billion. There were 116 decliners that edged out 89 advancers while 47 stocks were unchanged.

The day’s decline was led by PLDT, which shed 5.84 percent, while JG Summit, a key shareholder of the telecom firm, slid by 4.83 percent.

Speculations on the entry of a new telecom player gnawed on PLDT’s shares.

BDO, the day’s most actively traded stock, fell by 2.91 percent.

Jollibee, BPI and URC all declined by over 1 percent.

Outside of the PSEi, one notable decliner was TBGI, which fell by 17.02 percent. This company’s shares sizzled in recent days on potential telecom partnership play.

On the other hand, Metro Pacific added 1.36 percent while Ayala Land, Security Bank, Meralco, Ayala Corp., SM Investments, Globe Telecom, Semirara and GT Capital all firmed up.—DORIS DUMLAO-ABADILLA