The local stock barometer ended the week on a sluggish note as investors pared their holdings in large-cap stocks, tracking weaker regional markets.

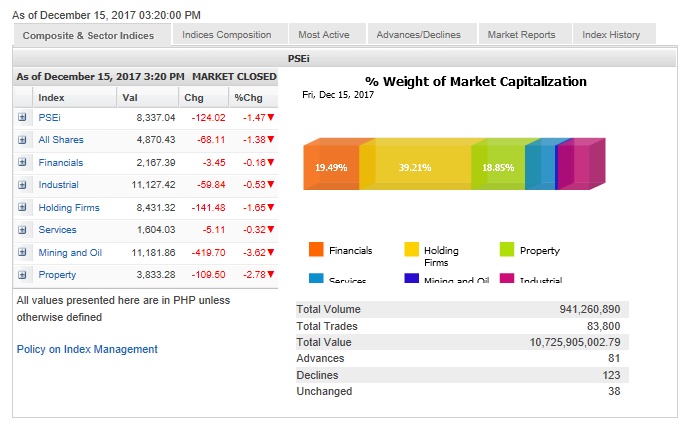

The main-share Philippine Stock Exchange index pulled back by 124.02 points or 1.47 percent to close at 8,337.04.

For the week, the PSEi was still ahead by 32.34 points or 0.04 percent due to earlier gains arising from optimism on the ratification of the local tax reform program. On Friday, optimism was tempered by an impending 20-percent increase in the stock transaction tax as part of the tax package.

On Friday, all counters ended in the red, led by the mining/oil and property counters which respectively slid by 3.62 percent and 2.78 percent.

The holding firm counter fell by 1.65 percent while the financial, industrial and services firms also slipped.

“Philippine stocks were sold down, a reversal from the bargain-hunting [Thursday]. This was the same case with US stocks ending in the negative territory on Thursday, while [ending] positive on Wednesday,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

“Investors were also selling on the news as a series of central bank meetings concluded for the year beginning with the Federal Open Market Committee night,” he said.

Value turnover was relatively heavy at P10.72 billion.

There were 123 decliners that edged out 81 advancers while 38 stocks were unchanged.

Investors sold down shares of coal mining and power generation firm Semirara, which lost 5.14 percent, while property giant SM Prime also lost 4.76 percent.