The local stock barometer surged to the 8,300 level on Friday as investors took heart from recent progress in US tax legislation.

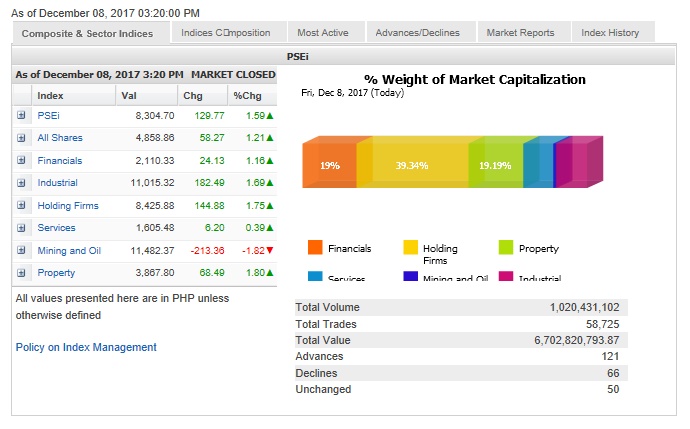

The main-share Philippine Stock Exchange index (PSEi) racked up 129.77 points or 1.59 percent to close at 8,304.70. This allowed the PSEi to post a total gain of 160.68 points or about 2 percent for the week.

“The Philippine market tried to establish new trading ground, breaking past 8,200 as part of the Christmas rally along the regional peers. Many are looking at the US tax reform, which is likely to cut taxes for both large and small firms, with a cut in the statutory corporate rate to 20 percent in 2019 and a significant individual tax deduction for pass-through profits in 2018,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

Except for the mining/oil counter, all sub-indices gained ground, led by the financial, industrial, holding firm and property counters, which all added over 1 percent.

On the other hand, the mining/oil counter fell by 1.82 percent due to a Senate proposal to jack up local excise taxes on coal, the primary fuel for many of the country’s power generation plants. A doubling of the excise tax on all non-metallic minerals and quarry resources, including copper, gold and chromite, was also proposed.

Total value turnover amounted to P6.7 billion. Despite the PSEi’s gain, foreigners were mostly sellers, resulting in a net foreign outflow of P37.3 million.

There were 121 advancers that overwhelmed 66 decliners while 50 stocks were unchanged.

The PSEi was lifted by the gains of URC, which rose by 5.88 percent, while Ayala Corp., GT Capital and JG Summit all firmed up by over 3 percent.