Calata delisting on Dec. 11

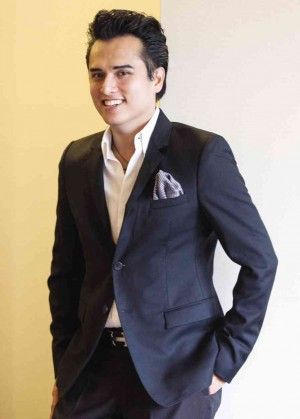

Joseph Calata. FILE PHOTO/RENE GUIDOTE

Controversial agribusiness firm Calata Corp. will be stricken off the Philippine Stock Exchange (PSE)’s roster of listed companies by Dec. 11 this year.

In a memorandum on Friday, PSE president Ramon Monzon noted that Calata – called out for multiple violations of disclosure requirements and trading restrictions – had submitted a motion for reconsideration (MR) following the PSE’s decision to delist the company.

“After due consideration and evaluation of the arguments presented in the MR, the exchange resolved to deny the company’s MR for lack of merit,” PSE president Ramon Monzon said.

As such, Monzon affirmed with finality the delisting of Calata’s shares and the imposition of concomitant penalties.

The involuntary delisting of Calata will result in a ban on its officers and directors from sitting on the board of any PSE-listed company for a period of five years. But in the case of company chair and chief executive officer Joseph Calata, PSE sources said he has been banned from the boardroom of any listed company indefinitely.

The PSE found out that Calata had committed a total of 29 violations of disclosure rules, having failed to disclose numerous trade transactions over shares held by its director/officer. The exchange also established that Calata committed 26 violations of the “black-out rule” which prohibits a director or principal officer of an issuer from trading securities during the prescribed period during which a material non-public information was obtained.

Calata disclosed in August and September 2016 its partnership with Sino-America Gaming Investment Group and Macau Resources Group Limited regarding the incorporation of Calata Land Inc. and its eventual transformation into a Real Estate Investment Trust, “which shall be used for the Mactan Leisure City.”

But after the period for the supposed incorporation of Calata Land in September 2016 and commencement of site works in January 2017 lapsed and until March 15, 2017, no update was given on the status of the Mactan Leisure City project. Hence, the PSE considered the directors and officers of the company to be in possession of material non-public information during the period when a certain director and officer traded its shares.

Separately, the Securities and Exchange Commission (SEC) filed a complaint against Calata and its officers for allegedly misleading investors about its gaming diversification despite the fact that the state-owned Philippine Amusement & Gaming Corp. (Pagcor) had already said it could not grant a license for the Mactan project, originally pitched by Macau Resources Group director Michael Foxman, who was accused as a co-conspirator in hyping Calata stocks.

Trading on Calata had been suspended since June 30 this year.

To recall, the PSE had earlier challenged Calata to make a tender offer to give small investors a chance to exit the company. Calata, however, had rejected the tender offer proposition. Citing its 2016 audited financial statements, Calata noted that it only had around P400 million of retained earnings while it would need to have around P1 billion to buy back its public shareholders.

Beleaguered Calata chair and founder Joseph Calata, in the meantime, proposed a shift to a “cryptocurrency exchange” where Calata would issue digital tokens to its shareholders that would be called “Calcoins” in the unregulated digital currency market.