Christmas optimism seen boosting stocks

No big movements are expected in the stock market today, although there is reason for investors to be more optimistic as the Christmas season—and the typical heavy consumer spending that comes with it—approaches.

Astro del Castillo, First Grade Finance Inc. managing director, said that with the lack of major drivers, investors would also be weighing the effects of the proposed tax reform package passed by the Senate.

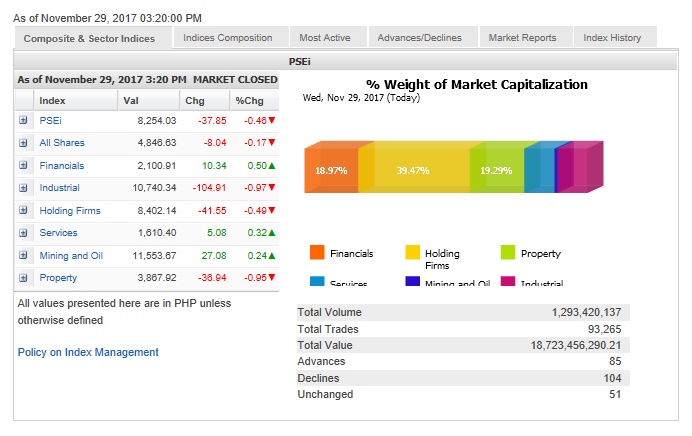

On Wednesday, the benchmark Philippine Stock Exchange index (PSEi) sank 0.46 percent to 8,254.03.

“It’s an opportunity to accumulate, given our prospects,” Del Castillo said. “If tax reform will be passed [earlier], that’s another reason for the market to buy now for 2018.”

He said more optimism and Christmas spending could fuel Philippine stocks in the near term. The PSEi, which has gained more than 20 percent so far this year, has pulled back in recent days.

Article continues after this advertisementTrading volume at the PSE was relatively high on Wednesday, with 1.3 billion shares valued at P18.7 billion changing hands. This was bolstered by special block sales of Ayala Land Inc., Puregold Price Club and Manila Electric Co. shares.

On Wednesday, foreign buying hit P13.8 billion while selling amounted to P12.6 billion. This amounted to a net foreign buying gain of P1.22 billion.