Investors train sight on tech stocks

Philippine Stock Exchange-listed technology stocks drew strong investor interest in the second-half of the year, riding a resurgence in global tech stocks and record gains in the local stock market.

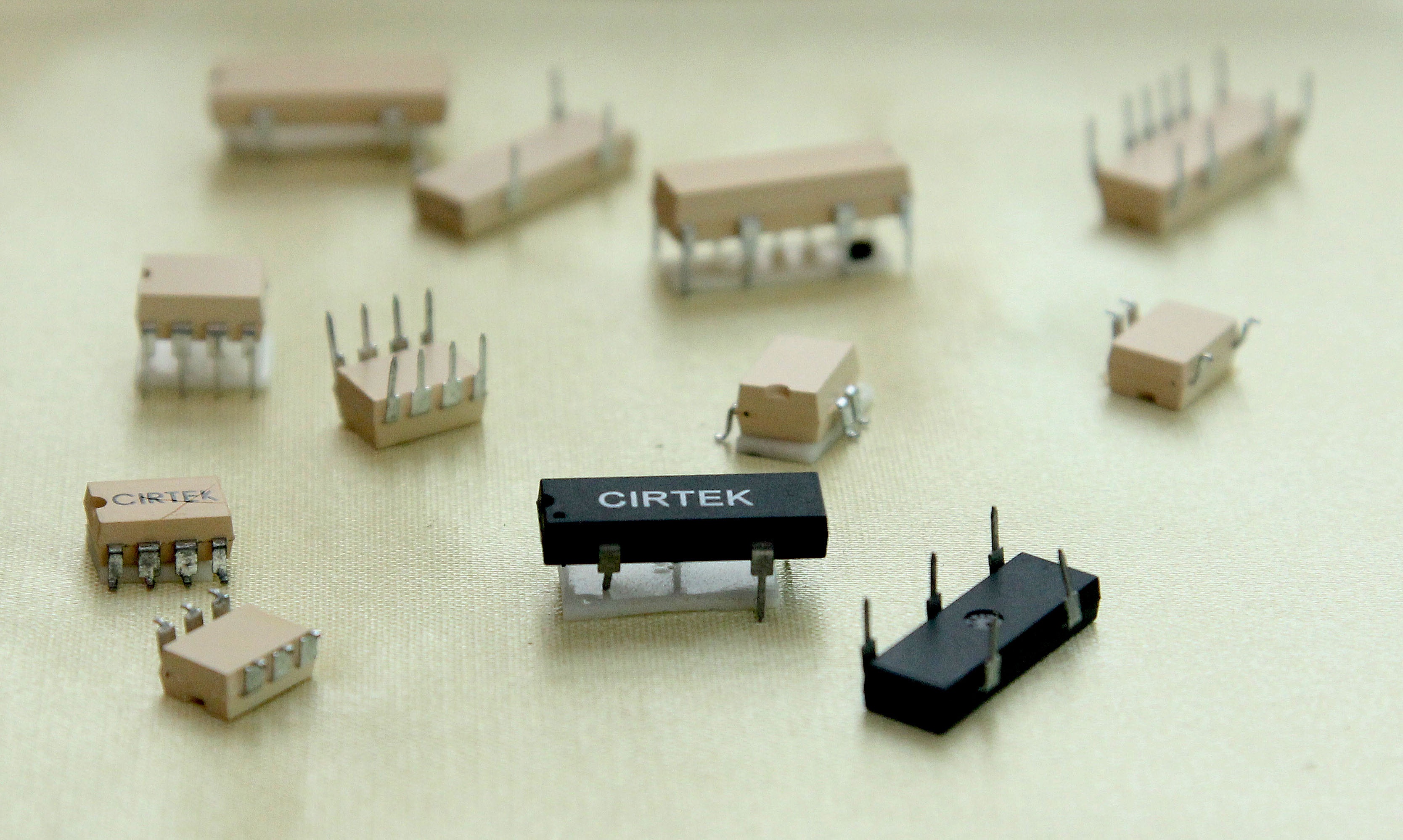

But the darling, clearly, is Cirtek Holdings Philippines Inc., whose share price scored a 70% gain at its PHP44.95 close on November 15 from its last trade at PHP26.50 on June 30. TECH is Cirtek’s trading symbol.

The closest pursuer from the same listed category had their share price advanced to 59.4% between June 30 and November 15 this year. Another player was also up 20.4% while another is down 12% over the period under review.

Aside from the record gain of the Philippine stock market—the PSE Index closed at 8,273.44 on November 15, up 5.49% from June, local tech stocks were also riding the crest of the advances made by international technology companies such as Apple, AMD and HP.

“It does not surprise the market to see the industry growing relatively-faster than other industries,” Philam Asset Management, Inc. Head of Investments Mr. Eduardo “Junie” Banaag remarked. He said it is necessary to deploy the latest standards for high-speed wireless communication in mobile devices and data terminals in emerging markets as data usage and availability of smart phones continue to increase.

On its own, Cirtek has been propelled by its acquisition in August of Quintel Technology Limited, a maker of multi-port antenna and a leader in the base station antenna in the U.S. whose clientele include Verizon and AT&T.

Quintel president and chief operating officer David Piazza is confident the company is on the right track. “We think that 2018 will be the breakout year for Quintel. We are a small startup competing with billion-dollar companies. But what we brought to the market is a disruptive technology. Now, we are already the dominant antenna supplier in Puerto Rico,” he added.

Other than Quintel, Cirtek is also looking at other initiatives that will lift the profile and revenue growth of the company in the medium- and long-term. Cirtek wants to leverage the company’s relationship with Facebook as well as the company of its director, Silicon Valley legend Dado Banatao.

Referring to Cirtek’s significant improvement in profitability and margins, Banaag shares,

“Intellectual [Property] Rights and continuing investments in research and development are valuable assets. Going forward, the market value of the business is likely to increase further and faster than the growth of its retained earnings.”

Meanwhile, the company will issue $60M non-voting preferred B-2 shares to fund research and development, raise capital, and pay debt obligations. The CHPC board approved to issue the shares at an offer price of $1 per share. ADVT