PH stock index regains some lost ground

The local stock barometer rebounded on Thursday as investors took recent dips as a signal to pick up stocks, albeit in a thin trading session.

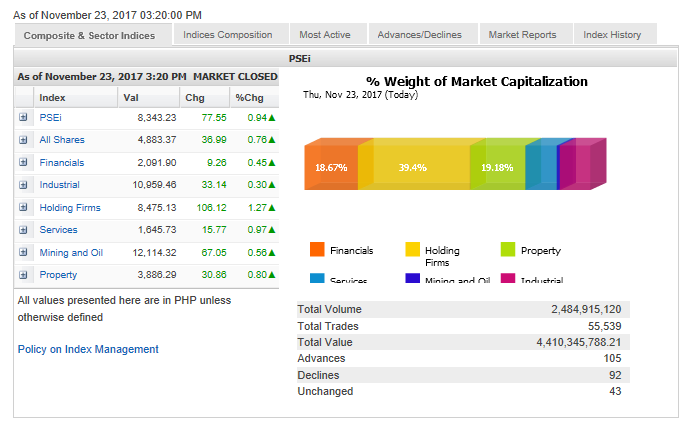

The main-share Philippine Stock Exchange index added 77.55 points or 0.94 percent to close at 8,343.23 while sentiment across regional markets was mixed.

“US stocks took a breather—DJIA (Dow Jones Industrial Average was down by 0.3 percent—as investors took some profit ahead of the Thanksgiving holiday. Despite a flat start on Wall Street’s leads, however, momentum remained positive, hence local investors saw the dips as quick and shallow, and bought with the low trading volumes,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

He noted that US stock market indices remained under pressure after the release of the latest US Federal Reserve minutes.

“The Fed viewed a near-term increase in interest rates as possible but central bank officials also expressed concerns about persistently low inflation, hinting that the bank might dial back its rate hikes in 2018. The language from the Fed’s Oct. 31-Nov. 1 meeting was comparatively softer than in the September discussions, reflecting worries that tepid inflation might also be a result of developments that could prove more persistent, according to the Fed minutes,” Limlingan added.

At the local market, all counters were up but the biggest gainer was the holding firm counter, which added 1.27 percent.

Value turnover for the day was relatively thin at P4.41 billion.

There were 105 advancers that edged out 92 decliners while 43 stocks were unchanged.

The PSEi was led higher by SM Investments, GT Capital, Megaworld and PLDT, which all advanced by over 1 percent.

Ayala Corp., BDO, Ayala land, BPI, Metrobank, Semirara, SM Prime and DMCI also contributed to the PSEi’s gains.

Outside the PSEi, notable gainers included Purefoods, which surged by 11.89 percent.

It was reported that parent conglomerate San Miguel Corp. also plans to consolidate its packaging business into the company.

PXP rose by 4.53 percent as the speculative play on joint Philippine-China drilling discussions resumed.